Income Tax Returns (ITR) filing in India involves the act of submitting an Income Tax Return (ITR) to the tax authorities. The taxpayers are obligated to file their income tax returns on a yearly basis if their income surpasses the predetermined threshold or if they seek to request a refund. The due date to file the ITR is July 31st 2023.

The last date for ITR filing of salaried taxpayers and individuals not requiring audit is 31st July 2023.

All the above ITRs except ITR 5 are available in the income tax portal for filing. However, the due date is 31st July.

As per the provisions outlined in Section 92A to Section 92F of the Income Tax Act, if a company enters into domestic or international transactions with associated enterprises, it is required to file Form 3CEB.

Form 3CEB is applicable to companies that participate in specified domestic transactions and international transactions with associated enterprises.

The Form 3CEB shall be filed by the partners in a firm and their spouses. The last date to file the same is 30th November. Furthermore, if either the husband or wife is subject to section 5A, the deadline of 30 November 2023 still applies.

The last date for the Partners in a firm with audited accounts is 31st October 2023.

If you miss the ITR filing due date, you can file a return after the due date, called a belated return.

Due to the ongoing server issues with the Income Tax Portal, it is recommended to submit the tax returns at the earliest opportunity.

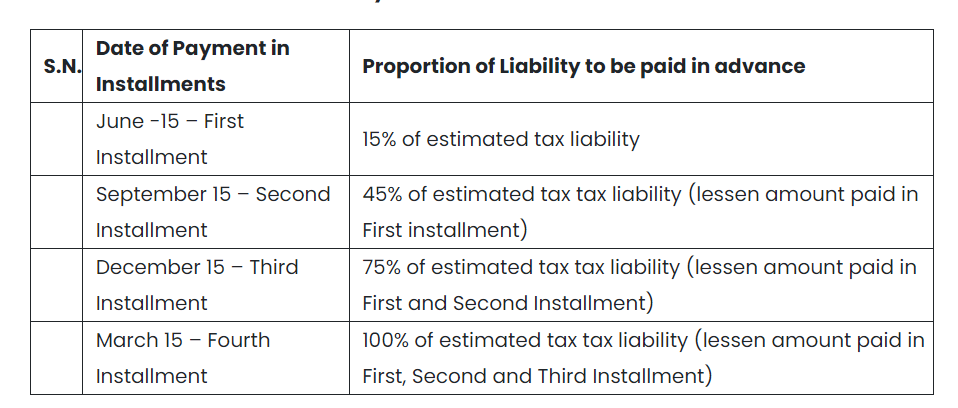

ADVANCE TAX FILING

The E- Payment is available for the payment of advance tax and it is mandatory for all corporates and also the assessees whose accounts are required to be audited under Section 44AB of the Income Tax Act, 1961.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates