The Income Tax Department launched its new E-filing portal on June 7th, 2021, so it is now directing to re-register the Digital Signature Certificate (DSC) on the new Income Tax e-filing portal.

What is DSC?

As per Section 140 of the IT Act 1961, the person responsible for signing the I-T return can be, typically, the Managing Director or any other Director (in case the MD is unavailable) in case of a Company; Any authorized person holding a legal power of attorney in case of a Non-resident Company; Managing Partner in case of a Firm or any other Partner (in case the Managing Partner is unavailable); Principal officer / Chief Executive Officer or Competent person in case of other entities such as Association of persons, Body of Individuals, Artificial Juridical person, Local Authority, Trust etc; Karta in case of a HUF; Self in case of an Individual or; Any authorized person holding a legal power of attorney in case the individual is incapable of signing the I-T Return or is absent from India.

Any person wishing to sign the Income Tax Return digitally has to complete the registration process for the DSC on the ner e-filing website (www.incometax.gov.in) prior to signing.

Any person could change or update his DSC registration any number of times.

What is Required for the DSC Registration?

For registering the DSC, the taxpayer must be having the Registered user of the e-Filing portal with valid user ID and password; Downloaded and installed the emsigner utility; The USB token procured from a Certifying Authority Provider should be plugged in to the computer; DSC USB token should be Class 2 or Class 3 Certificate; DSC to be registered should be active and not expired; and DSC should not be revoked.

Procedure of Registration on the New Portal

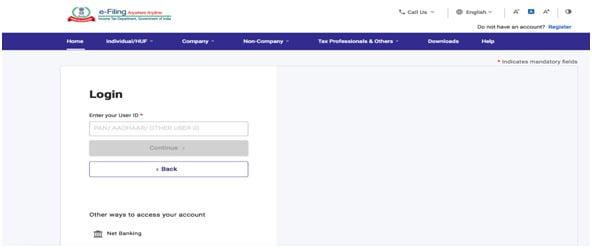

Step-1: The authorized signatory or Individual would log into the E-filing website(www.incometax.gov.in) using the Login particulars such as the userid which may be your Aadhar Number, PAN or any other ID and password of the company / firm / HUF / Individual etc.

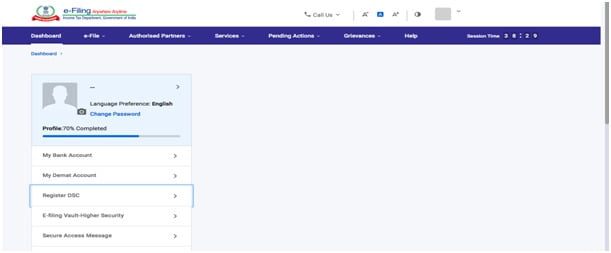

Step-2: Click on ‘My Profile’ from the Dashboard.

Step-3: Now, at the left side of the screen, click on the ‘Register DSC’.

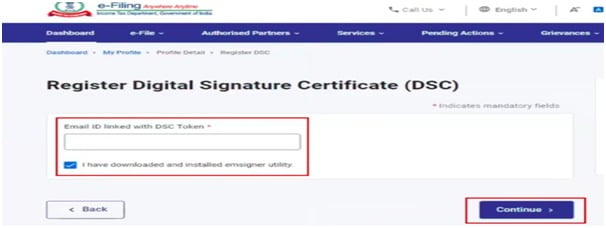

Step-4: Enter the linked mail id then select “I have downloaded and installed emsigner utility” and click on ‘Continue’.

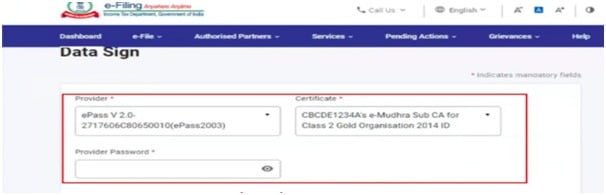

Step-5: Lastly, select the Provider and Certificate. Enter Provider Password. Click on ‘Sign’.

If the validation is successful then a message will be displayed with the option to go to the Dashboard.

Support our journalism by subscribing to Taxscan AdFree. We welcome your comments at info@taxscan.in