The Income Tax Department has released the offline utilities of Income Tax Returns (ITR)- 2 for the Assessment Year 2023-24. Till now, the offline utilities of ITR-1, ITR-2 and ITR-4 are available now in its latest version of JSON schema.

The department has stated the utility of ITR 3 will be available shortly.

Recently, the department has also released the offline excel utility for Income Tax Returns (ITR)- 5 for the Assessment Year 2023-24 on 9th June 2023. The zip file includes the ITR from 5 CSV and Instruction of 112A and 115D which has an excel sheet. And also CSV and Instruction of TDS 1 and TDS 2.

Read More: Income Tax Department Releases Excel Utility for ITR 5 for Assessment Year 2023-24

Also, The Central Board of Direct Taxes (CBDT) enables common offline utility for filing Income Tax Returns ITR -1 and ITR – 4 for the Assessment Year (A.Y.) 2023-24 on 9th June 2023

Read More: Income Tax Returns: CBDT enables Common Offline Utility for ITR-1 and ITR-4

The last date to file the income tax returns is without penalty for the Assessment Year (A.Y.) 2023-24 is July 31st 2023.

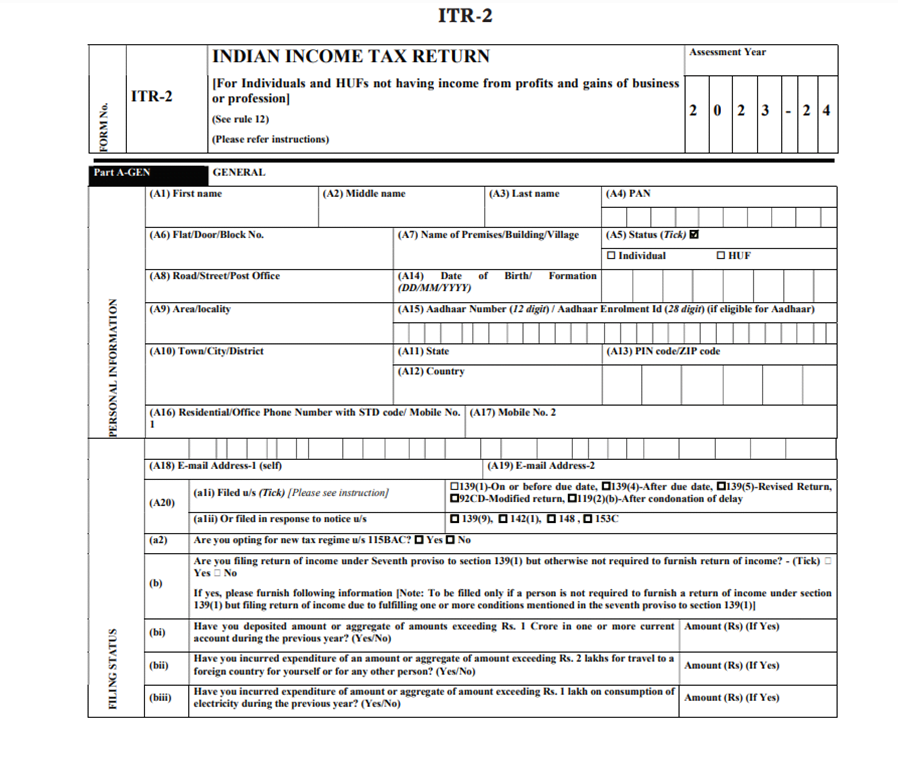

The ITR 2 is for the filing of a group including people including Hindu Undivided Families (HUFs) without a source of income from a business or profession. Individuals with income from salaries, multiple homes, capital gains, overseas assets, and other sources are eligible to utilise this form.

Read More: 50 Days Left to file Income Tax Returns (ITR): All You Need to Know

Download the Utility:

Utility Excel Based (Version 1.1) (5.62 MB) – Date of release of latest version of utility 10-June-2023

Date of release of first version of utility – 11-May-2023

Document: Schema – Date of latest release of JSON Schema 20-June-2023

Date of first release of JSON Schema- 12-Apr-2023

Schema Change Document (version 1.1) (131 KB)

Validations (524 KB)

ITR2_Notified Form AY 2023-24 (1513 KB)

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates