The result of the Post Qualification Diploma in International Taxation has been declared by the Institute of Chartered Accountants of India (ICAI) on 5th May 2023. The ICAI has commenced the Diploma in International Taxation with a view to help the members to build the capacities in the area of international taxation. The exam is only applicable to the qualified chartered accountants who have their membership number.

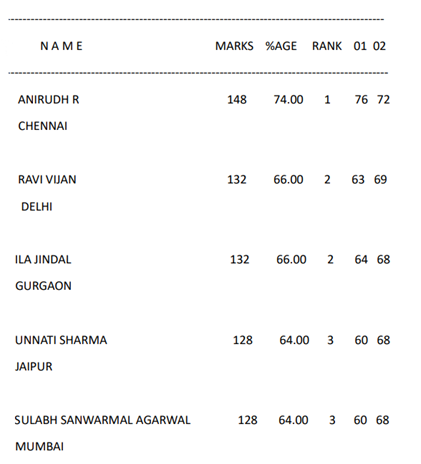

Anirudh, hailing from Chennai, achieved the first position with a score of 148 marks (74%). Ravi Jain from Delhi and Ila Jindal from Gurgaon jointly secured the second position, both scoring 132 marks (66%). Unnati Sharma from Jaipur and Sulabh Sanwarmal Agarwal from Mumbai shared the third rank with a score of 128 marks (64%).

Also read: CA Exam Results: Boys Secures First Three Positions in Final; ICAI Unveils Toppers’ List

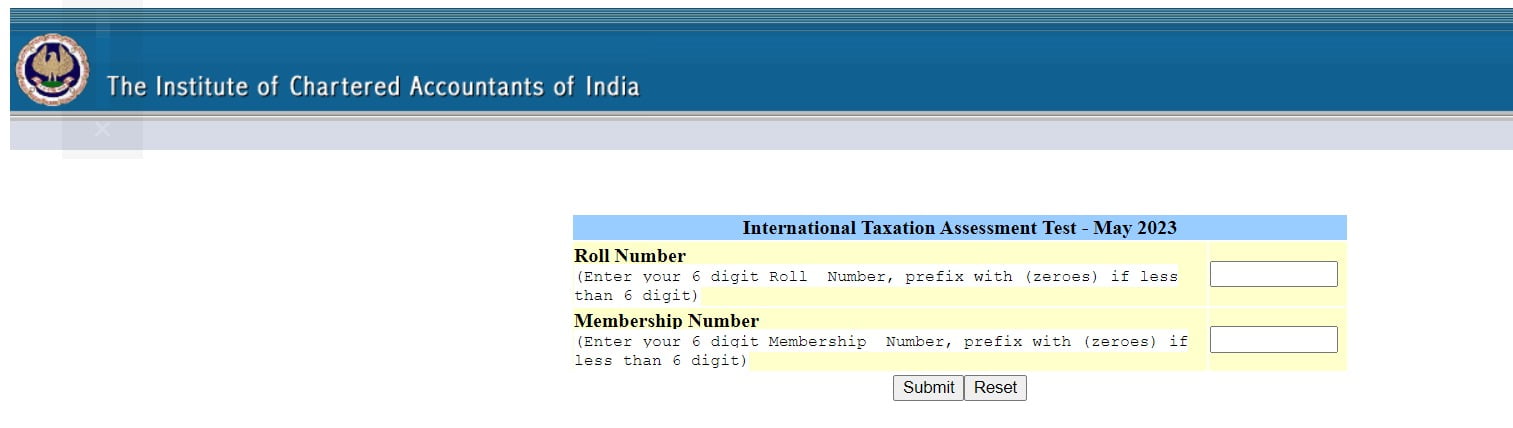

How to check your result:

COURSE STRUCTURE

(i) The Diploma in International Taxation shall include 126 hours International taxation Professional Training (INTT PT) and Assessment Test (INTT AT).

(ii) A candidate who has successfully passed the Diploma in International Taxation shall be awarded a Diploma certificate in the appropriate form and be entitled to use the letters ‘DIIT (ICAI)’ after his name.

The Course fee amounts to Rs. 28,000, which covers a 126-hour International Taxation Professional Training (INTT PT) and Background Material for the Course. In the event that a participant wishes to cancel their registration before the start of the batch, cancellation charges of 10% of the gross fee paid will apply. However, once the batch has commenced, no cancellation requests will be accepted.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates