Background

One of the major functions of a Tax Administration in a country is to increase, as much as possible, the Revenue of the treasury and the easiest way to do the same is by increasing the taxpayer base. But guess what, the Indian GST Administration seems to differ! And here’s why;

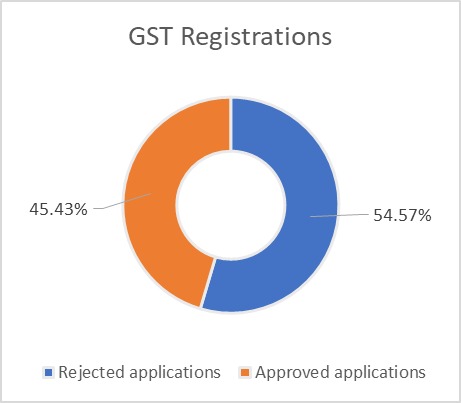

Per the Right to Information data pertaining to GST registrations in the country, the following staggering data appears:

The aforementioned data pertains to the period from Apr 20 – March 23. Also, recently, in one of his interviews, the Chairman of CBIC stated that currently only 40% of the corporate income taxpayer base is registered under GST which is double the number when GST was rolled out in July 2017. Therefore, while the taxpayer base under GST has doubled over last six years, it is alarmingly low as compared to number of corporates paying income tax.

Therefore, we see that over time, the department has been reluctant and strict in granting GST registrations. But the question is – why? Why is the department across the country against the whole purpose GST, i.e., One Nation, One Tax, while requiring dissimilar and distinct set of documents for registrations when compared from one state to another? Let us have a look a few possible reasons for such modus operandi.

Why is department not approving GST registrations?

Amidst the widespread outcry regarding the increasing difficulty in obtaining GST registrations, the question arises as to why the authorities are reluctant to grant these registrations. It’s evident that the Government aims to expand the taxpayer base, so what could be the underlying reason behind this hesitation?

Fake Registrations and consequent passing of ITC effectively means nil revenue for the treasury, and the numbers for the same are just staggering. In a recent joint operation by the Kerala and Karnataka Tax Officials, a staggering total of 30 fake registrants spread across the country, operating under benami firms was discovered. The illicit operation had an estimated total business turnover of INR 850 Crores between October 2022 and June 2023[1]. The entities involved generated fake invoices and e-way bills to conceal the illicit transportation of Goods[2]. The gravity of the said situation is ascertained when we refer to the facts and figures till July 2023. Like they say, numbers speak for themselves.

The issue first starts from a fake registration using which an entity not conducting any business or not present in the Registered place of business, issues fake invoices without any actual supply of goods and services. These acts are usually carried out to pass fraudulent ITC on to other entities, which later use such ITC to set off actual tax liabilities, which would effectively mean that the government receives no revenue.

Time for another brain teaser then, how do these entities effectuate such frauds? Let us say a bogus supplier issues fake invoices to entities without any actual supply of goods or services, against which the other party makes the payment through a cheque which the bogus entity draws and after taking some amount cut, returns the said payment back to the payer. Now, in this scenario, the payer can claim the ITC of the tax paid on inward supplies to set off its actual tax liability at a later stage, without being involved in any taxable supply or receipt of goods. The abovementioned example is one of the ways where the Government’s revenue faces a leakage.

The game between the Department and the fraudulent taxpayer thus becomes like cat and mouse chase and it seems that the fraudulent taxpayers always have something up their sleeves to be a step ahead of the department until the latter knows what actually hit them. Thus, not letting such potential fraudulent taxpayers in game is rather a strategic genius. But then, it is absolutely not as simple as one would think. Taxation system is the backbone of any Nation’s economy. Therefore, an ideal regulation of the same, is an equally quintessential task. In the aforementioned context, the regulation of Indirect Taxation, in specific, which is central to all the business and economic transactions in the country, requires an optimal balance between regulatory/legal compliances and the ease of doing business for the stakeholders. Thus, it is important to under the regulatory framework around GST

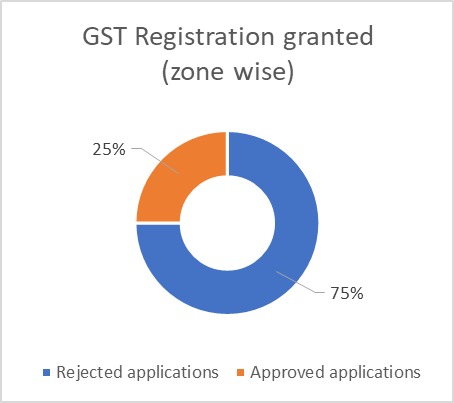

In light of rampant cases of fake registrations and non-genuine taxpayers, The Central and State Tax Administrators launched a Special All-India Drive from May 16, 2023 to July 15, 2023 against fake GST registrations and bogus ITC invoicing which would be identified using data analytical tools. Post the conclusion of this drive, the Finance Ministry informed Lok Sabha about the following statistics:

It must be borne in mind that these numbers are in addition to the above numbers. Now we have understood that the revenue has an uphill task in curbing such cases of fake registration. But, however noble the goal of the department may be, the impact of such a stance and outlook, could affect the potential businesses across the country and may have a detrimental effect on the economy. Furthermore, the department has to be extremely cautious and reasonable in firstly assessing the registration application at the initial stages and subsequently while cancelation of the GST registration. Even once the registration is obtained, the taxpayer seems to run the risk of cancellation of registration.

Section 29 of the Act provides for the several conditions for cancelation of the registration which inter alia are: contravention of provisions of the Act; Non-furnishing of annual return beyond 3 months of the due date of filing; non-commencement of business post voluntary registration; registration obtained by fraud, willful mis-statement, or suppression of facts. The power of cancelation of registration where the Proper Officer deems it fit to do so seems wide. This discretion upon the Proper Officer thus, is required to be exercised judiciously and should be with proper reasoning, as discretion without reason is arbitrary and unjustifiably prejudicial to the Assessee.

Judicial Precedents

In this regard, multiple judicial precedents have favored taxpayers. The Hon’ble Gujarat High Court in the case of Sona Metals Versus State Of Gujarat TS-259-HC(GUJ)-2023-GST, quashed the SCN for cancelation of registration, as the same was issued without identifying any reasons and was cryptic; furthermore the court held that the Department should have mentioned the details as to how the Assessee has committed, fraud, willful misstatement or suppression of facts while obtaining the registration.

The Gujarat High Court in the supra cited judgment referred to the judgement in the case of Aggarwal Dyeing and Printing Works v. State of Gujarat and Ors., wherein the court had held that the validity of the notice is quashed on the grounds that notice does not divulge necessary information upon which the Assessee is able to file a response. The department in this case had canceled the registration on grounds of continuous non-filing of the returns, which according to the Assessee was on account of ‘nil’ turnover.

The Delhi High Court in the case of Rishiraj Aluminum Pvt. Ltd. v. Goods and Services Tax Officer [WP (C) No. 4125 of 2023], set aside the Show Cause Notice and restored petitioner’s registration as the same did not sufficiently disclose the reasons of suspension of GST registration and proposed cancelation.

Furthermore, the Gujarat High Court in the case of Vahanvati Steels v. State of Gujarat 2022 (4) TMI 1242 observed that the show cause notice is bereft of any material particulars and details in the absence of which it is difficult for any individual to respond such a vague show cause notice.

It is pertinent to infer from all these cases that there have been times where the tax authorities have without any specifically outlined reasons and without any fault on part of the Assessee, canceled its registrations. Furthermore, there have been cases where registrations have been canceled on grounds of genuine disability of the Assessee without any fraudulent intention on their part. Therefore, it is absolutely necessary that the Tax Officers exercise discretion on cancelation with utmost caution, care, reason and diligence, otherwise the said acts are only the breeding ground for needless litigation.

In this regard it is relevant to note the judgment of the Hon’ble Gujarat High Court in the case of Suguna Cutpiece Centre v. Appellate Dy. Commissioner WP No. 25048 of 2021, where the court had held the following:

“The provisions of the GST Act cannot be interpreted in a manner, so as to debar as the assessee, either from obtaining registration or reviving the cancelled registration. Such interpretation would be not only contrary to Article 19(1)(g), but will also be in violation of Article 14 and 21”

Apart from the revenue reasons as cited above, striking a balance between optimal regulatory framework and an equally conducive business environment is extremely necessary in reigning the minds which have the discretion and power in their acts, in a way that they mutually co-exist and are in a symbiotic relationship and not a parasitic one; because if the regulations becomes too stringent, ease of doing business decreases and the treasury loses revenue; on the other hand if the regulation is rather lenient, it becomes easier for the business entities to evade taxes, consequently flourish, but eventually drag the revenue down. The ITC angle here cannot be missed. To ensure that all taxpayers in the country avail their legitimate ITC, and there are fewer ITC litigations, regulating GST registrations is the first step in this direction. Thus, in this regulatory limit conundrum, the taxman, the taxpayer and all the other stakeholders are faced with rather difficult and twisted questions:

The Government’s message is quite loud and clear – To plug the fake entities and protect the honest ones. The same was reiterated by the CBIC chief wherein he said “I warn those who continue to do this that we come at them with a very heavy hand…. We want a larger but clean taxpayer base so that honest taxpayers are protected”. Without doubt, the intention is quite clear, however, in the process, there is some bit of agitation that the honest taxpayers may have to face. Since this is for a larger good, there will be some bonafide taxpayers who might have to bear the brunt.

[1] The Hindu Bureau, “Kerala, Karnataka tax officials bust GST registration cartel” The Hindu, Kerala, Karnataka tax officials bust GST registration cartel – The Hindu; Last Accessed on July 11, 2017.

[2] Cited Supra

Mr. Jigar Doshi, Founding Partner, TMSL

Nikita Maheshwari, Senior Manager, TMSL

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates