The Indian Government has made significant strides in the last 4 years in taking India to new heights in terms of the welfare of the citizenry, the overall structure& growth of the economy, and creating a strong presence as an emerging global power.

To fuel such achievements, the Government has worked tirelessly for shouldering a number of bold and important socio-economic reforms. The Government has undertaken its reform drive with the spirit of inclusiveness of the marginalized and hitherto socio-economically neglected classes in the overall development process. To this end, right at the beginning of its term, theGovernment came-up with the Pradhan Mantri Jan DhanYojana(PMJDY) in August 2014, for giving space to the deprived classes into the formal banking system and making Financial Inclusion as its prime goal. Pradhan Mantri Jan DhanYojana’s success has led to the creation of the much needed financial infrastructure, which serves as a runway for taking-off other Social Security Schemes like Atal Pension Yojana (APY), Pradhan MantriSurakshaBimaYojana(PMSBY) and Pradhan MantriJeevanJyotiBimaYojana(PMJJBY).

Taking a step further towards up-liftment of the neglected, the Government recognized the need for targeted welfare reforms to cater to special needs of certain sections of the society. In this direction, the Government came-up with Pradhan MantriSukanyaSamridhiYojana, which provides financial security to the girl child when she grows up.

Not only financial security, but also the financial independence of the women was taken care of through Stand Up India Scheme, which expands its ambit to Schedule Castes and Schedule Tribes. Stand Up India gives subsidized loans to harness and ignite the latent entrepreneurial zeal of the hitherto disadvantaged communities.

Financial needs of all the stakeholders ranging from the budding entrepreneurs to the hard-working farmers have also been catered to through various initiatives.An important initiative in this direction is the Pradhan Mantri MUDRA Yojana. During the Financial Year 2018-19, the number of loans sanctioned are 2,81,08,814 with total amount sanctioned worth Rs.1,48,503.57 Crore, with total amount disbursed Rs.1,42,009.91 Crore.

Alongside the farmer’s needs have also been addressed. The Kisan Credit Card Scheme (KCC) was strengthened for contributing towards the liberation of peasantry from the shackles of exploitative money lenders by improving their access to formal credit.

Reforms and initiatives like GST, Demonetization, Operation Clean Money and Insolvency and Bankruptcy Code have made the Indian economy more efficient and transparentand haveensured financial discipline along with better compliance.

The success of Government’s policies is further reaffirmed and underscored when the International Organizations like the World Bank and IMF recognize India as the fastest growing Emerging Economyin the world and applaud the resilient and stable growth India has witnessed.

According to a recent World Bank report, India is a top improver in the Ease of Doing Business Rankings for the second year in a row. India has improved 65 places from 142 to 77 in span of last 4 years which is a remarkable achievement in itself.

A Department-wise description of the Major Activities undertaken during the year 2018 is as follows.

I . Department of Economic Affairs (DEA)

Ø Overall fundamentals of the economy remained strong for the Year 2018-19

| Macroeconomic Indicator | For Year 2018-19 |

| GDP Growth Rate (%) | 7.1 (Up to Q2) |

| CPI | 3.9% (Q2) |

| WPI | 4.64% (over November, 2017) |

| Current Account Deficit (CAD) | US$ 15.8 billion (Q1) |

| Trade Deficit | US$ 45.7 billion (Q1) |

| External Debt to GDP Ratio (%) | 20.5% ( till March, 2018) |

| FDI Inflows | US $16,868 million (April –June, 2018) |

| Foreign Exchange Reserves | US$ 393.7 billion

(As on November 30, 2018) |

(Source; RBI Bulletin,PIB Website)

Ø GDP and the Economy

The Indian Economy is on track to maintain a high growth rate in the current global environment.

The share of Indian economy in world(measured as a ratio of India’s GDP to world’s GDP at current US$) increased from 2.6 percent in 2014 to 3.2 percent in 2017 (as per World Development Indicators database). The average share of Indian economy in world during 1960 to 2013 was 1.8 percent. The average growth of the Indian economy during 2014-15 to 2017-18 was 7.3 per cent, fastest among the major economies in the world.

Indian economy is projected to be the fastest growing major economy in 2018-19 and 2019-20 (International Monetary Fund October 2018 database). This is borne by GDP growth of 7.6 per cent in the first half of 2018-19.

The Second Quarter has seen a reasonable overall GDP growth of 7.1%. The H-1 2018-19 growth of the GDP is 7.6% and the H-1 GVA growth is 7.4%. The Growth in the Second Quarter is on higher base compared to the growth of the First Quarter.

The Manufacturing Growth on a base of 7.1% in Q2 2017-18 has been 7.4% in Q2 of 2018-19. The Construction Sector has grown by 7.8%. The Gross Fixed Capital Formation as a ratio of GDP has increased by almost 1.3 percentage points over Q2 of last year. The Exports for Q-2 have grown by 13.4%. The Government consumption for the Quarter has also significantly increased by 12.7%.

This is ratified in the reports of International Organizations like World Economic Forum.

As per the World Economic Situation and Prospects 2018 Report of the United Nations, the outlook for India remains largely positive, underpinned by robust private consumption and public investment as well as ongoing structural reforms.

According to the World Bank’s Ease of Doing Business 2018 Report, India’s ranking improved by 65 positions to 77th rank in 2018.

The Government of India has taken various initiatives to improve the confidence in the Indian economy and boost the growth of the economy and which, inter-alia, include; fillip to manufacturing, concrete measures for transport and power sectors as well as other urban and rural infrastructure, comprehensive reforms in the foreign direct investment policy, special package for textile industry, push to infrastructure development by giving infrastructure status to affordable housing and focus on coastal connectivity.

Inflation during 2017-18 Averaged to the Lowest in the Last Six Years

Inflation in the country continued to moderate during 2017-18. Consumer Price Index(CPI) based headline inflation averaged 3.3 per cent during the period which is the lowest in the last six financial years. This has been stated in the Economic Survey 2017-18 placed in Parliament by the Union Minister for Finance and Corporate Affairs, Shri Arun Jaitley.

This progress is a result of a number of initiatives and reforms undertaken by the government which follows in the subsequent pages.

Ø Curbing Black Money

The Government first targeted the black money outside India. Asset holders were asked to bring this money back on payment of penal tax. Those who failed to do so are being prosecuted under the Black Money Act. Details of all accounts and assets abroad which have reached the Government resulted in action against the violators.

Steps for Curbing the Black Money stashed abroad has led to Positive Results

The Government of India has taken various steps for curbing the black money stashed abroad, which has led to positive results. These steps include the following:

Unearthing Benami Property

Cabinet approves appointment of Adjudicating Authority and establishment of Appellate Tribunal under Prohibition of Benami Property Transactions Act, 1988. The approval will result in effective and better administration of cases referred to the Adjudicating Authority and speedy disposal of appeals filed against the order of the Adjudicating Authority before the Appellate Tribunal.

Under the Benami Transactions Informants Reward Scheme, 2018, a person can get reward up to Rs. One crore for giving specific information in prescribed manner to the Joint or Additional Commissioners of Benami Prohibition Units (BPUs) in Investigation Directorates of Income Tax Department about benami transactions and properties as well as proceeds from such properties which are actionable under Benami Property Transactions Act, 1988, as amended by Benami Transactions (Prohibition) Amendment Act, 2016.

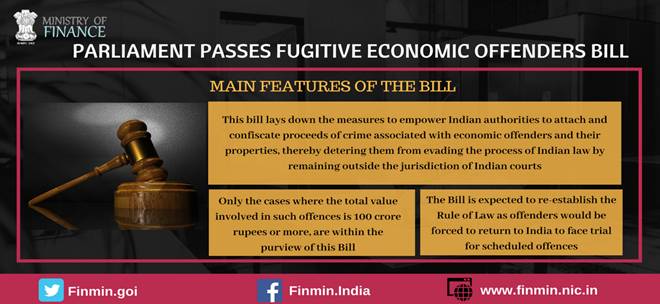

With the assent of the President of India, the Fugitive Economic Offenders Ordinance, 2018 was promulgated; New law laid down the measures to empower Indian authorities to attach and confiscate the proceeds of crime associated with economic offenders and the properties of the economic offenders.

The Union Cabinet chaired by Prime Minister Shri NarendraModi, has approved the proposal of the Ministry of Finance to introduce the Fugitive Economic Offenders Bill, 2018 in Parliament. The Bill would help in laying down measures to deter economic offenders from evading the process of Indian law by remaining outside the jurisdiction of Indian courts.

The cases where the total value involved in such offences is Rs.100 crore or more, will come under the purview of this Bill.

Impact:

The Bill is expected to re-establish the rule of law with respect to the fugitive economic offenders as they would be forced to return to India to face trial for scheduled offences. This would also help the banks and other financial institutions to achieve higher recovery from financial defaults committed by such fugitive economic offenders, improving the financial health of such institutions.

Task Force on Shell Companies took pro-active and coordinated steps to check the menace of shell companies: The major achievements of the Task Force include the compilation of a database of shell companies by SFIO. This database, as on date, comprises of 3 lists, viz the Confirmed List, Derived List and Suspect List. The Confirmed List has a total of 16,537 confirmed shell companies on the basis of the information received from the various Law Enforcement Agencies of the companies found to be involved in illegal activities.

Ø Push to MSME sector:

Prime Minister Shri NarendraModi launched historic Support and Outreach Initiative for MSME Sector

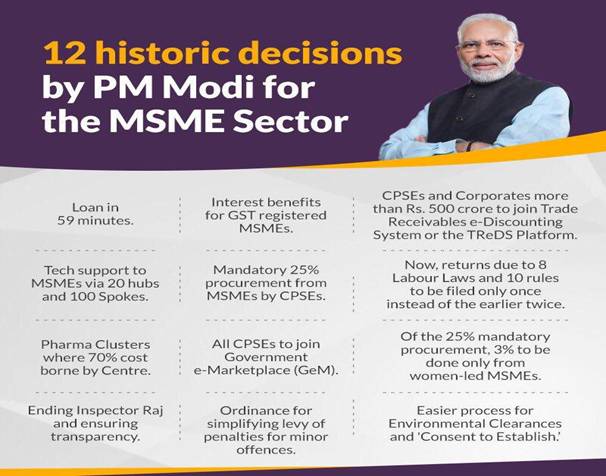

The Prime Minister, Shri NarendraModi, launched a historic support and outreach programme for the Micro, Small and Medium Enterprises (MSME) sector. As part of this programme, the Prime Minister unveiled 12 key initiatives which will help the growth, expansion and facilitation of MSMEs across the country.

The Prime Minister said that the success of economic reforms launched by the Union Government can be gauged from the rise in India’s “Ease of Doing Business Rankings,” from 142 to 77 in four years.

The Prime Minister said that there are five key aspects for facilitating the MSME sector. These include access to credit, access to market, technology upgradation, ease of doing business, and a sense of security for employees. He said that as a Diwali gift for the sector, the 12 announcements he is making, will address each of these five categories.

Access to Credit

As the First Announcement, the Prime Minister announced the launch of the 59 minute loan portal to enable easy access to credit for MSMEs. He said that loans uptoRs. 1 crore can be granted in-principle approval through this portal, in just 59 minutes. He said a link to this portal will be made available through the GST portal. The Prime Minister asserted that in New India, no one should be compelled to visit a bank branch repeatedly.

The Prime Minister mentioned the Second Announcement as a 2 percent interest subvention for all GST registered MSMEs, on fresh or incremental loans. For exporters who receive loans in the pre-shipment and post-shipment period, the Prime Minister announced an increase in interest rebate from 3 percent to 5 percent.

The Third Announcement made by the Prime Minister was that all companies with a turnover more than Rs. 500 crore, must now compulsorily be brought on the Trade Receivables e-Discounting System (TReDS). He said that joining this portal will enable entrepreneurs to access credit from banks, based ontheir upcoming receivables. This will resolve their problems of cash cycle.

Access to Markets

The Prime Minister said that on access to markets for entrepreneurs, the Union Government has taken a number of steps already. In this context, he made his Fourth Announcement thatPublic Sector Companies have now been asked to compulsorily procure 25 percent, instead of 20 percent of their total purchases, from MSMEs.

The Prime Minister said his Fifth Announcement is related to women entrepreneurs. He said that out of the 25 percent procurement mandated from MSMEs, 3 percent must now be reserved for women entrepreneurs.

The Prime Minister said that more than 1.5 lakh suppliers have now registered with GeM, out of which 40,000 are MSMEs. He said transactions worth more than Rs. 14,000 crore have been made so far through GeM. He said the Sixth Announcement is that all Public Sector Undertakings of the Union Government must now compulsorily be a part of GeM. He said they should also get all their vendors registered on GeM.

Technology Upgradation

Coming to technological upgradation, the Prime Minister said that tool rooms across the country are a vital part of product design. His seventh announcement was that 20 hubs will be formed across the country, and 100 spokes in the form of tool rooms will be established.

Ease of Doing Business

On Ease of Doing Business, the Prime Minister’sEighth Announcement was related to pharma companies. He said clusters will be formed of pharma MSMEs. He said 70 percent cost of establishing these clusters will be borne by the Union Government.

The Prime Minister’sNinth Announcement on Simplification of Government Procedures was that the return under 8 labour laws and 10 Union regulations must now be filed only once a year.

The Prime Minister’s Tenth Announcement was that now the establishments to be visited by an Inspector will be decided through a computerised random allotment.

The Prime Minister noted that as part of establishing a unit, an entrepreneur needs two clearances namely, environmental clearance and consent to establish. HisEleventh Announcement was that under air pollution and water pollution laws, now both these have been merged as a single consent. He further said that the return will be accepted through self-certification.

As the Twelfth Announcement, the Prime Minister mentioned that an Ordinance had been brought, under which, for minor violations under the Companies Act, the entrepreneur will no longer have to approach the Courts, but can correct them through simple procedures.

Social Security for MSME Sector Employees

The Prime Minister also spoke of social security for the MSME sector employees. He said that a mission will be launched to ensure that they have Jan Dhan Accounts, Provident Fund and Insurance.

The Prime Minister said that these decisions would go a long way in strengthening the MSME sector in India. He said the implementation of this Outreach Programme will be intensively monitored over the next 100 days.

Ø SIDBI launched a National Level Entrepreneurship Awareness Campaign, UdyamAbhilasha (उद्यमअभिलाषा)in 115 Aspirational Districts identified by NITI Aayog in 28 States and reaching to around 15,000 youth.

Ø Sovereign Gold Bond Scheme 2018 -19: TheGovernment of India, in consultation with the Reserve Bank of India, has decided to issue Sovereign Gold Bonds-2018-19. The Sovereign Gold Bonds will be issued every month from October 2018 to February 2019.

Ø Fifteenth Finance Commission constituted a High Level Group to examine the strengths and weaknesses for enabling balanced expansion of Health Sector

The Fifteenth Finance Commission has constituted a High Level Group consisting of eminent experts from across the country in Health Sector. Dr. RandeepGuleria, Director, AIIMS, New Delhi will be its Convenor.

Ø International Agreements and Engagements

There have been a number of International Agreements and Engagements that has helped India to increase and enhance its Global Presence.

Some of the International appointments and engagements are as under:

Some Important Loan Agreements:

II . Department of Revenue

Ø GST

This year on 1st July 2018, theGovernment of India celebrated the 1st GST Day.

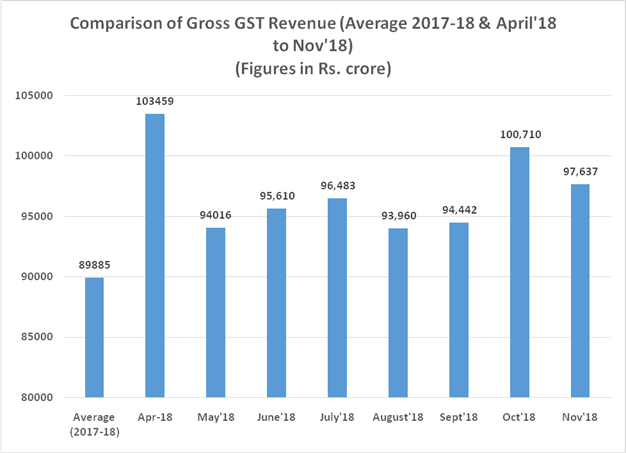

GST Revenue Collections:

The GST Revenue collection for the month of November 2018 has crossed Ninety-Seven Thousand Crore rupees. The total gross GST revenue collected in the month of November, 2018 is Rs. 97,637 crore of which CGST is Rs. 16,812 crore, SGST is Rs. 23,070 crore, IGST is Rs. 49,726 crore (including Rs. 24,133crore collected on imports) and Cess is Rs. 8,031 crore (including Rs. 842 crore collected on imports).

Ø GST Council: Important decisions

GST Council 31st Meeting:

GST Rate Cuts on Goods

GST Council in the 31st Meeting held on 22nd December, 2018 at New Delhi took following major decisions relating to changes in GST rates, and clarification (on goods). The decisions of the GST Council have been presented for easy understanding. The same would be given effect to through Gazette notifications/ circulars which shall have force of law.

III. GST on solar power generating plant and other renewable energy plants

GST Rate Cuts on Services

GST Council in the 31stmeeting held on 22nd December, 2018 at New Delhi took following decisions relating to changes in GST rates, ITC eligibility criteria, exemptions andclarificationson connected issues.The decisions of the GST Council have been presented in this note in simple language for easyunderstanding. The same would be given effect to through Gazette notifications/ circulars which shall have force of law.

Reduction in GST rates/exemptions on Services:

Rationalization

GST Council’s 30th Meeting:

During the 30th Meeting of the GST Council, the proposal of the State of Kerala for imposition of Cess on SGST for rehabilitation and flood affected works was discussed in detail. The Council decided to constitute a 7-Member Group of Ministers (GoM) to examine this issue in depth. Accordingly, the Union Finance Minister, Shri ArunJaitley, had approved the constitution of a Group of Ministers on 28thSeptember, 2018 to examine the issue regarding ‘Modalities for Revenue Mobilization in case of Natural Calamities and Disasters’.

GST Council :28th Meeting:

The GST Council in its 28th Meeting took the following decisions on GST Rate on Goods and Services.

GST Rate on Goods:

III. GST rates were recommended to be brought down from,-

o Stone/Marble/Wood Deities

o Rakhi [other than that of precious or semi-precious material of chapter 71]

o Sanitary Napkins,

o Coir pith compost

o Sal Leaves siali leaves and their products and Sabai Rope

o PhoolBhariJhadoo [Raw material for Jhadoo]

o Khali dona.

o Circulation and commemorative coins, sold by Security Printing and Minting Corporation of India Ltd [SPMCIL] to Ministry of Finance.

o Chenille fabrics and other fabrics under heading 5801

o Handloom dari

o Phosphoric acid (fertilizer grade only).

o Knitted cap/topi having retail sale value not exceeding Rs. 1,000

o Bamboo flooring.

o Brass Kerosene Pressure Stove.

o Hand Operated Rubber Roller.

o Zip and Slide Fasteners.

o Ethanol for sale to Oil Marketing Companies for blending with fuel

o Solid bio fuel pellets

o 5% GST is being extended to footwear having a retail sale price up to Rs. 1000 per pair

o Footwear having a retail sale price exceeding Rs. 1000 per pair will continue to attract 18%

V.GST rates were recommended to be brought down for specified handicraft items [as per the definition of handicraft, as approved by the GST council]

o Handbags including pouches and purses; jewellery box

o Wooden frames for painting, photographs, mirrors etc

o Art ware of cork [including articles of sholapith]

o Stone art ware, stone inlay work

o Ornamental framed mirrors

o Glass statues [other than those of crystal]

o Glass art ware [ including pots, jars, votive, cask, cake cover, tulip bottle, vase ]

o Art ware of iron

o Art ware of brass, copper/ copper alloys, electro plated with nickel/silver

o Aluminium art ware

o Handcrafted lamps (including panchloga lamp)

o Worked vegetable or mineral carving, articles thereof, articles of wax, of stearin, of natural gums or natural resins or of modelling pastes etc, (including articles of lac, shellac)

o Ganjifa card

o Handmade carpets and other handmade textile floor coverings (including namda/gabba)

o Handmade lace

o Hand-woven tapestries

o Hand-made braids and ornamental trimming in the piece

o Toran

o IGST @5% on Pool Issue Price (PIP) of Urea imported on Government account for direct agriculture use, instead of assessable value plus custom duty.

o Exemption from Compensation cess to Coal rejects from washery [arising out of cess paid coal on which ITC has not been taken].

GST Rate on Services

The GST Council in its 28th meeting took following decisions relating to exemptions / changes in GST rates / ITC eligibility criteria, rationalization of rates / exemptions and clarification on levy of GST on services.

It would be noted that multiple reliefs from GST taxation have been provided to following categories of services –

(i) Agriculture, farming and food processing industry,

(ii) Education, training and skill development,

(iii) Pension, social security and old age support.

Hotel industry has been given major relief by providing that the rate of tax on accommodation service shall be based on transaction value instead of declared tariff.

Services provided in sectors like banking, IT have been provided relief by exempting services supplied by an establishment of a person in India to any establishment of that person outside India [related party].

As a green initiative, GST on supply of e-books has been reduced from 18 to 5%.

EXEMPTIONS / CHANGES IN GST RATES AND SERVICES

Sector –Farmers/ Agriculture/ Food Processing

Education/ Training/ Skill Development

Social Security/ Pension Security/ Senior Citizens

Banking/ Finance/ Insurance

Government Services

Miscellaneous

Also, the GST Council in its 28th Meeting had approved the New Return Formats and associated changes in law. It may be recalled that in the 27thMeeting held on 4thof May, 2018, the Council had approved the basic principles of GST return design and directed the law committee to finalize the return formats and changes in law. The formats and business process approved in 28th meeting were in line with the basic principles with one major change i.e., the option of filing quarterly return with monthly payment of tax in a simplified return format by the small tax payers.

GST Refunds

Total GST refunds to the tune of Rs 91,149 crores have been disposed by CBIC and State authorities out of the total refund claims of Rs 97,202 crores received so far. Thus, the disposal rate of 93.77 per cent has been achieved. The pending GST refund claims amounting to Rs 6,053 crores are being expeditiously processed so as to provide relief to eligible claimants. Refund claims without any deficiency are being cleared expeditiously.

GST Evasion

Ø E-way Bill System

The E-way Bill System had been introduced nation-wide for inter-State movement of goods with effect from 1st April, 2018 while the States were given the option to choose any date till 3rd June, 2018 for the introduction of the E-way bill system for intra-State supplies. The objectives of E-way bill system are as below:

Ø Demonetization and Unearthing Black Money

The larger purpose of demonetisation was to move India from a Tax Non-compliant society to a compliant society. This necessarily involved the formalization of the Economy and a blow to the black money.

Demonetization compelled holders of cash to deposit the same in the banks. The enormity of cash deposited and identified with the owner resulted in suspected 17.42 lakh account holders from whom the response has been received online through non-invasive method. Larger deposits in banks improved lending capacity for the banks. A lot of this money was diverted to the Mutual Funds for further investments. It became a part of the formal system.

The impact of demonetization has been felt on collection of personal income tax. Its collections were higher in Financial Year 2018-19 (till 31-10-2018) compared to the previous year by 20.2%. Even in the corporate tax the collections are 19.5% higher. From two years prior to demonetization, direct tax collections have increased 6.6% and 9% respectively. In the next two years, post demonetization the increase by 14.6% (part of the year before impact of demonetization in 2016-17) and an increase of 18% in the year 2017-18.

Appropriate action by the Income-tax Department (ITD) and other Law Enforcement Agencies has been taken against those involved in the misuse of the Scheme of Demonetization.

During the period November 2016 to March, 2017, ITD conducted searches in 900 groups, involved in various activities and business, leading to seizure of Rs. 900 crores, including cash seizure of Rs. 636 crores. During the same period, 8239 surveys were conducted leading to detection of undisclosed income of Rs. 6745 crores.

With the objective of obtaining people’s participation in the Income Tax Department’s efforts to unearth black money and reduce tax evasion, a new reward scheme titled “Income Tax Informants Reward Scheme, 2018” has been issued by the Income Tax Department, superseding the earlier reward scheme issued in 2007.

Central Board of Direct Taxes (CBDT)

The Central Board of Direct Taxes (CBDT) has entered into nine more Unilateral Advance Pricing Agreements (UAPAs) during the month of July, 2018. With the signing of these Agreements, the total number ofAPAs entered into by the CBDT has gone up to 232, which includes 20 Bilateral Advance Pricing Agreements (BAPAs).

Ø Direct Tax

There has been continuous increase in the amount of income declared in the returns filed by all categories of taxpayers over the last three Assessment Years (AYs). For AY 2014-15, corresponding to FY 2013-14 (base year), the return filers had declared gross total income of Rs.26.92 lakh crore, which has increased by 67% to Rs.44.88 lakh crore for AY 2017-18, showing higher level of compliance resulting from various legislative and administrative measures taken by the Government, including effective enforcement measures against tax evasion.

Refunds amounting to Rs.1.23 lakh crore have been issued during April, 2018 to November, 2018, which is 20.8% higher than refunds issued during the same period in the preceding year.

So far as the Growth Rate for Corporate Income Tax (CIT) and Personal Income Tax (PIT) is concerned, the Growth Rate of Gross Collections for CIT is 17.7% while that for PIT (including STT) is 18.3%.

According to the Direct Tax Statistics released by CBDT:

III.Department of Financial Services

Ø Reforms for addressing the Non-Performing Assets (NPAs) of Public Sector Banks (PSBs):

The government has strongly come out with key measures and reforms in order to address the increase in NPAs, which are detailed as under.

Government moved proposal in Parliament for enhanced bank re-capitalisation outlay from Rs.65,000 crore to Rs.1,06,000 crore in the current financial year to propel economic growth, cementing India’s position as the fastest growing economy of the world. This would enable infusion of over Rs.83,000 in Public Sector Banks (PSBs).

The enhanced provision is aimed at:

(1) Meeting regulatory capital norms

(2) Providing capital to better-performing PCA Banks to achieve 9% Capital to Risk-weighted Asset Ratio (CRAR); 1.875% Capital Conservation Buffer and the 6% Net NPA threshold, facilitating them to come out of PCA

(3) Facilitating non-PCA banks that are in breach of some PCA thresholds to not be in breach

(4) Strengthen amalgamating banks by providing regulatory and growth capital

Following comprehensive clean-up of the banking system under Government’s 4R’s approach of Recognition, Resolution, Recapitalisation and Reforms, the envisaged recapitalisation would equip banks financially at levels higher than the global norms. In this connection, it is pertinent that India’s capital norms for banks are 1% higher than the norms recommended under the global Basel-III framework. Further, unlike the early intervention regime of other major economies, India’s PCA framework for weaker banks has more onerous thresholds, viz., higher capital thresholds and a Net NPA threshold that further embeds capital requirement on account of provisioning of NPAs. Today’s proposal in an expression of Government’s commitment that each PSB is an article of faith, and aims at securing compliance even for the higher regulatory norms.

The reforms agenda aimed at Enhanced Access & Service Excellence (EASE), encapsulates a synergistic approach to ensuring prudential and clean lending, better customer service, enhanced credit availability, focus on Micro, Small and Medium Enterprises (MSMEs), and better governance.

With a view to enable Regional Rural Banks (RRBs) to minimize their overhead expenses, optimize the use of technology, enhance the capital base and area of operation and increase their exposure, the Government has sought comments of respective State Governments and Sponsor Banks on a roadmap for Amalgamation of RRBs within a State.

Apart from these measures, a number of other measures have been undertaken. As a result, PSBs recovered an amount of Rs. 1,58,259 crore, during the financial years 2015-16 to 2017-18.

Ø Global Recognition of Government’s Reform Drive

The reform drive undertaken by the government has been recognized by International Organizations like Standard &Poor’s which states, inter-alia, that “the worst is almost over for India’s banks”. It states that the Government is working on a four-pronged strategy to improve the health of the banking sector: recognition, resolution, recapitalisation and reform (“4Rs”), and that their stable outlook on the banks reflect their view that the “4Rs” and other initiatives taken by the Government and RBI will strengthen the banking system over the next couple of years.

Ø Streamlining of National Pension System (NPS)

The Union Cabinet in its Meeting on 6th December, 2018 has approved the following

Ø Financial Inclusion

Finance Ministry launches Mobile Application “Jan DhanDarshak” as a part of Financial Inclusion

Department of Financial Services (DFS), Ministry of Finance and National Informatics Centre (NIC) has jointly developed a mobile app called Jan DhanDarshak as a part of financial inclusion (FI) initiative . As the name suggests, this app will act as a guide for the common people in locating a financial service touch point at a given location in the country.

Ø Major Schemes and their Improvements:

Issue of Kisan Credit Cards

There is positive growth in terms of both individual policies as well as first year premium during 2017-18. Apart from interest rates, there are other factors which affect the life insurance growth such as overall economic growth, sales force, product portfolio, level of competition with other financial products etc.

Pradhan Mantri Jan DhanYojana (PMJDY): Under Pradhan Mantri Jan DhanYojana33.4 Crore beneficiaries banked so far ₹85,494.69 Crore balance in beneficiary accounts as on 17th December, 2018

Pradhan MantriVayaVandanaYojana extended up to March 2020: Exemption of Interest Income on deposits increased to Rs 50,000. Existed limit on investment under PMVVY enhanced to Rs 15 lakhs.

SukanyaSamridhi Account Scheme: Until 30 June, 2018 more than 1.39 crore accounts have been opened across the country in the name of girl-child securing an amount of Rs.25,979.62crore.

Atal Pension Scheme: The Subscriber base under APY has crossed 1.24 crore mark; More than 27 lacs new subscribers have joined the Scheme during the Current Financial Year 2018-19 (As on 2nd November,2018). The Scheme is very easy to understand and it is very transparent. States like Uttar Pradesh, Bihar, Andhra Pradesh, Maharashtra and Karnataka are the top contributors in APY enrollment. The Scheme allows any Indian Citizen between the age group of 18-40 years to join through the bank or post office branches where one has the savings bank account.

Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Pradhan MantriJeevan Jyoti Bima Yojana (PMJJBY)

Pradhan Mantri Mudra Yojana

Pradhan Mantri MUDRA Yojana (PMMY) is a scheme launched by the Hon’ble Prime Minister on April 8, 2015 for providing loans upto 10 lakh to the non-corporate, non-farm small/micro enterprises. These loans are classified as MUDRA loans under PMMY. During the financial year 2018-19, the number of loan sanctioned are 2,92,30,665 with total amount sanctioned Rs. 1,53,783.83Crores, with total amount disbursed Rs.1,47,115.20Crores (As 14th December,2018)

Stand Up India Scheme

Progress around Stand-Up India Scheme is as under

| Performance under Stand Up India Scheme | (Amt. in Rs. Crore) | ||||||||||||||||||

| SC | ST | Women | Total | ||||||||||||||||

| Date | |||||||||||||||||||

| No Of | Sanctioned | No Of | Sanctioned | No Of | Sanctioned | No Of | Sanctioned | ||||||||||||

| A/Cs | Amt. | A/Cs | Amt. | A/Cs | Amt. | A/Cs | Amt. | ||||||||||||

| 31.10.2018 | 9175 | 1776.87 | 2770 | 557.35 | 54135 | 12096.91 | 66080 | 14431.14 | |||||||||||

Rates of Small Saving Schemes was increased for Financial Year 2018-19.

Ø Public Financial Management System (PFMS) Achieves a Historical Record Breaking Volume of Digital Transaction

Public Financial Management System (PFMS) is an ambitious project of Government of India being implemented by Controller General of Accounts, Ministry of Finance. PFMS has proved as a robust digital platform towards Prime Minister’s vision of DIGITAL INDIA.

On 28th March, 2018, an historic amount of Rs. 71,633.45 crore has been digitally transacted/routed through PFMS Portal for 98, 19,026 transactions in a single day.

| NAME OF CPSES | % OF GOIS SHARES DISINVESTED | RECEIPTS (In Crores) | GOIS SHAREHOLDING POST DISINVESTMENT |

| Mishra Dhatu Nigam Ltd. (MIDHANI) | 25 | 434.14 | 75% |

| Bharat 22 ETF | – | 8325.26 | – |

| RITES | 12.60 | 460.51 | 87.40% |

| Garden Reach Shipbuilders and Engineers Ltd. | 25.5 | 342.90 | 74.5% |

| Coal India Ltd. | 3.19 | 5218.30 | 75.46% |

| KIOCL Ltd. | 1.983 | 205.34 | 99.06% |

| HSCC (India) Ltd. | 100 | 285.00 | – |

| CPSE-Exchange Traded Fund | (FFO3) | 17000.00 | – |

| National Aluminium Company Ltd. | 1.80 | 260.41 | 56.77% |

| NLC India Ltd. | – | 989.86 | – |

| Coal India Ltd. | 0.01 | 17.33 | 75.12% |

(Source – DIPAM site)

V . Department of Expenditure