The Goods and Services Tax Network (GSTN) has issued an important advisory regarding the registration and returns filing of the person supplying online money gaming servicers or Online Information Database Access and Retrieval services (OIDAR) or both on 17th October 2023.

The advisory states as follows:

“General: In terms of the recent amendments made in the CGST/SGST Act, the IGST Act and the CGST/SGST Rules, any person located outside taxable territory making supply of online money gaming to a person in taxable territory, is liable to get registered in GST and is required to pay tax on such supply. In this context, every person located outside taxable territory making such supplies of online money gaming to a person in India is now mandated to take registration/amend his existing registration in accordance with the proposed Row (iia) in FORM GST REG-10 and also required to furnish information regarding the supplies in the proposed Tables in FORM GSTR-5A. GSTN is in the process of developing the functionality of such new registrations or required amendment in existing registration, as the case may be. In the meantime, till the said functionality is made available on the portal, a workaround is suggested to be followed as below:

1.Registration(Form GST REG-10)

2. Return(Form GSTR-5A)

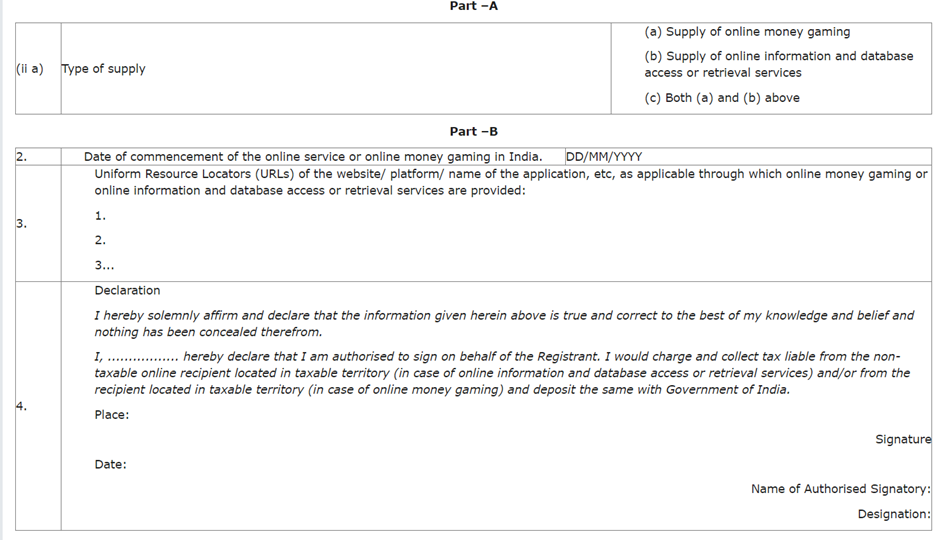

*Additional Information REG-10 form.

(Kindly fill the details and upload this documents in pdf format with other documents)

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates