Attention, Non-resident Goods and Services Tax ( GST ) payers, this serves as a crucial reminder. The deadline for submitting your GSTR-5 in GST Portal for the month of December 2023 is imminent, with the last day being tomorrow, January 13, 2024.

GSTR-5

Form GSTR-5 is a return to be filed by all persons registered as Non- Resident Taxpayer (NRTP). Non- Resident Taxpayers need to file a return in Form GSTR-5 for the period for which they have obtained registration within a period of seven days after the date of expiry of registration.

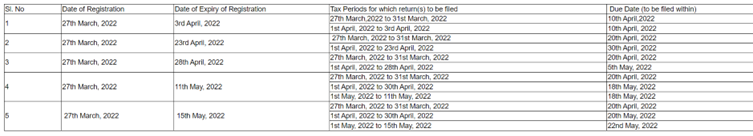

In case, validity of registration is more than one month, monthly return (s) should be filed by 13th of the month (applicable from October 2022) and 20th of the month(for return periods from July 2017 till Sep 2022) succeeding the tax period or within seven days of closing the business whichever is earlier, as illustrated in the table below:

Form GSTR-5 can be accessed on the GST Portal, post login in the Returns Dashboard by the taxpayer. Go to Services > Returns > Returns Dashboard. No, there is no offline tool for Form GSTR-5.

Pre-conditions for filing Form GSTR-5

It is imperative to ensure the timely filing of your returns to comply with regulatory requirements and avoid any potential penalties. Take prompt action to fulfil your GST obligations by submitting your GSTR-5 before the specified deadline.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates