The allegation of a leaked Multiple Choice Questions (MCQs) of an Institute of Chartered Accountants of India (ICAI) Exam – Financial Reporting [FR] of the May 2024 Final Exams has sparked heated discussions on Social Media, especially X, formerly Twitter.

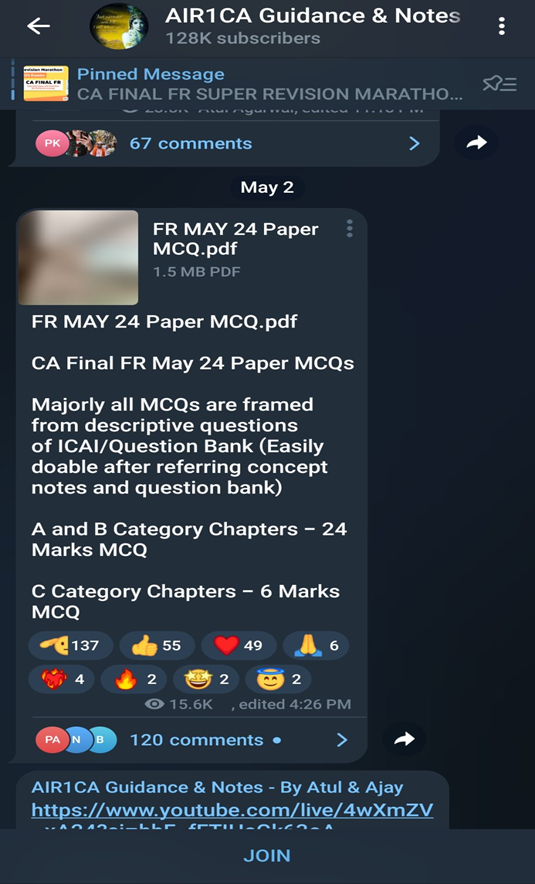

The discussion centers around a message in a telegram account named AIR1CA Guidance & Notes which states that the May 24th FR exam paper was posted as an MCQ in PDF format.

Sources close to the matter revealed that the MCQs were shared in the Telegram group hours before the scheduled end of the exam. This development has sparked outrage among students and the accounting community, with demands for a thorough investigation into the incident.

Professionals involved in the discussion question the integrity of the Institute if the exam quality is being compromised. The discussion thread includes further comments from users speculating on the legitimacy of the leak and the potential ramifications for the Institute. Some are reproduced here: –

Notably, a professional tweeted that, “Metadata of leaked paper That shows that pdf was created way before exam WTH is going on???”

“This is the Metadata of the said PDE It suggests that the pdf was created/modified on 10:54 am of May 02, 2024. Meaning the paper could have been leaked way before it appeared on the Internet”, stated the source tweet.

Amidst recent news of the ICAI paper leak, where individuals were found to have gained access to confidential exam papers, it is crucial to stay informed and vigilant about various aspects of financial compliance, including income tax filing. Choosing the right Income Tax Return (ITR) form is an essential step in ensuring accurate and lawful tax filings.

Enrol Now to Stay informed of Income Tax Forms ITR-1 and ITR-4: https://academy.taxscan.in/course/live-online-3-days-course-on-in-depth-analysis-of-itr-1-and-itr-4/

By understanding your income sources, filing obligations, and the applicability of each ITR form, you can select the one that aligns best with your financial situation. If you are uncertain about which form to use, seeking guidance from a tax professional, such as a Chartered Accountant, or enrolling in an ITR filing course can provide valuable insights and assistance. Courses offered by platforms like Taxscan Academy can offer comprehensive knowledge on ITR forms and their nuances, aiding in making informed decisions regarding tax filings.

Coming Back to the discussion of the hour, one of the replies to the original tweet observed that, “Bro that is UTC time zone. translates to 4.24pm IST only. Not before the exam for sure. Also, metadata can be modified in a minute. Don’t make others tense by these useless posts.”

Another CA aspirant tweeted the issues faced by students on the first day of the ICAI CA Final Exams, counting three major setbacks.

It is important to note that the information in the screenshot cannot be independently verified and the Institute has not yet issued a statement on the matter. The leaked MCQs incident has brought the spotlight on secure conduct of examinations and the measures taken by ICAI to prevent such leaks.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates