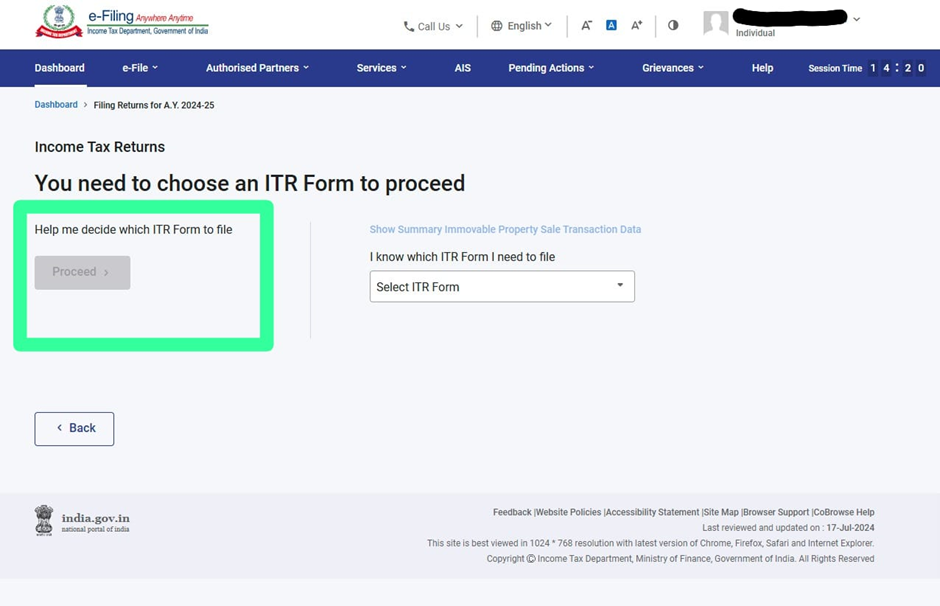

The Income tax portal is not helping the self-filing taxpayers. The option to ‘‘Help me decide which ITR form to file” was blacked out. The option serves very much help to the income taxpayers who file their income tax returns. This could be a technical issue, however as the due date is nearing, this technical glitch will trouble the taxpayers file their returns on their own.

“Help me decide which ITR form to file”

Individual taxpayers must use different ITR forms based on their type of income and residential status. Up until AY 2019-20, no service existed to assist individual taxpayers in identifying the appropriate ITR form and schedules applicable to their circumstances. Starting from AY 2020-21, the “Help me decide which ITR form to file” service has been introduced. This service aids taxpayers in determining the correct ITR form to use, both online and via the offline utility.

This service helps individual taxpayers determine the correct ITR form and applicable schedules with these options:

Help me decide which ITR form to file:

Proceed based on qualifying conditions: Review the qualifying conditions for ITR-1, ITR-2, ITR-3, and ITR-4. Once you understand which ITR form applies to your situation, select the appropriate one and proceed with the ITR filing.

Still not clear, let us help you: If you’re unsure which ITR to file after reading the conditions, choose this option. Answer the wizard-based questions relevant to your situation to determine the appropriate ITR form.

Help me determine the schedules by clicking Learn more:

If you’re unsure which schedules apply, click ‘Learn More’ and answer the relevant questions for each schedule. The applicable schedules will be activated based on your responses.

This technical glitch affects self-filers who previously filed ITR-1 but have a change in their income source, such as from a business profession. They now need to file a different ITR. Detailed instructions are provided in the Help tab to guide them through this process. However, the same has been blacked out due to the technical issues.

Learn How to File various GST Returns and Earn from everywhere. Buy this Book.