As the Chartered Accountants Final Examination for November 2024 approaches, the Institute of Chartered Accountants of India ( ICAI ) has highlighted several common errors that candidates often make while filling out the online application form and reiterated the conditions for continuation of permanent exemption.

Adhering to the correct procedures is vital to avoid complications during the application process for the CA Final Examinations.

Ready to Grow? Choose a Course That Fits Your Goals!

Selecting the Medium

Candidates must carefully select their preferred medium of examination—either English or Hindi. It is imperative to verify this selection on the confirmation page before proceeding to make the online payment. Failure to do so will result in English being automatically selected as the medium, and no requests for changes will be entertained after this point.

Choosing the Examination Centre

Selecting the correct examination centre is another critical step. Candidates should double-check their choice of centre on the confirmation page before making any payment. A detailed list of examination centres is available at ICAI Examination Centres under the title “City Master-Final-November 2024”.

Group Applied

Candidates need to accurately mark the group they intend to appear for in the upcoming examination and ensure this is correct on the confirmation page before proceeding with the payment. It’s important to note that re-appearing in a group that has already been passed is a violation of the Chartered Accountants Regulations, 1988.

Ready to Grow? Choose a Course That Fits Your Goals!

Exemptions

All valid exemptions will be automatically displayed in the exam form filling area on the SSP ( Self Service Portal ). For any doubts regarding exemptions, candidates can write to final.exemption@icai.in for clarification, the ICAI added.

It was stated that, “The valid exemption as per papers in New Scheme will be auto displayed in the exam form filling area in SSP. However, Candidates are required to verify the same and give details of exemptions that they feel are not covered. You may write to final.exemption@icai.in, in case of any doubt.

e. Payment is to be made online only.

After filling up the form, check the same to see if all the details, ( more particularly the fields

relating to, medium, centre, Group applied and Exemption ), have been filled in correctly before proceeding to make online payment.

3) Candidates are advised to keep a copy of PDF file generated on successful payment, for future reference.

4) Admit cards of all the candidates will be hosted on https://eservices.icai.org generally 14

days prior to the commencement of the examination. All candidates are required to print their admit cards from the website. No physical admit card will be sent to any candidate.

5) Candidates have the option of writing the answers in Hindi or in English. Such option should be clearly exercised at the time of filling up the form. Read Paragraph 15 in this regard.

6) Exemption granted is valid for immediate next three examinations only and during this period, exemption in other subject(s) of the same group is not granted even if a candidate secures 60 or more marks.

7) Candidates with permanent disabilities are advised to refer to Point no. 16 carefully.

8) (a) Frequently Asked Questions on “Exemption(s) in a paper(s)” are hosted on the FAQ section of the Institute’s website www.icai.org Candidates may visit the same for detailed clarifications.

(b) Exemption(s) from appearing in a paper(s) or Group of CA Exams, under the New Scheme of Education and Training w.e.f. May 2024 examinations and further clarifications on them are hosted under the Announcement/s dated 24th August, 2023 in the Institute’s website

www.icai.org. Candidates may visit the same for detailed clarifications.”

A candidate who has passed in any one but not in both the Groups or Units of the Final Examination under the syllabus approved by the Council under regulation 31 or of the Final Examination as per the syllabus under paragraph 3 or 3A of Schedule B to these regulations or paragraph 3 of Schedule BB to the Chartered Accountants Regulations, 1964 ( two Groups or Units scheme after January 1, 1985 ) enforced at the relevant time shall be eligible for exemption in that particular Group or Unit and shall be required to appear and pass in the remaining Group or Unit in order to pass the Final Examination.

Ready to Grow? Choose a Course That Fits Your Goals!

The Council may frame guidelines to continue to award exemption in a paper or papers to a candidate, granted earlier under the syllabus approved under clause (iv) of regulation 31 for the unexpired chance or chances of the exemption in the corresponding paper or papers in which he had secured exemption, if the corresponding paper or papers exist in the new syllabus of the Final Examination approved by the Council under clause (v) of regulation 31.

On appearing in the examination of the corresponding paper or papers in which he had failed, he shall be declared to have passed the examination, if he secures at one sitting a minimum of forty per cent. marks in the corresponding paper or papers in which he had failed earlier and a minimum of fifty per cent. marks in the aggregate of all the papers of the Group or Unit including the marks of the paper or papers in which he had earlier been granted exemption by the Council.

The detailed Announcement is available at the below link- https://resource.cdn.icai.org/75658exam61200.pdf

Notwithstanding anything contained above, a candidate who has appeared in all the papers comprised in a Group or Unit and fails in one or more papers comprised in a Group or Unit but secures a minimum of sixty per cent. marks in any paper or papers of that Group or Unit shall be eligible to appear at any one or more of the immediately next three following examinations in the paper or papers in which he secured less than sixty per cent. Marks:

Provided that he shall be declared to have passed in that Group or Unit, if he secures at one sitting a minimum of forty per cent. marks in each of such papers and a minimum of fifty per cent. of the total marks of all papers of that Group or Unit including the paper or papers in which he had secured a minimum of sixty per cent. marks in the earlier examination referred to above: Provided further that he shall not be eligible for any further exemption in the remaining paper or papers of that Group or Unit until he has exhausted the exemption already granted to him in that Group or Unit.

Ready to Grow? Choose a Course That Fits Your Goals!

If a candidate has exhausted the exemption granted to him as above and he was not able to pass the said Group or Unit, he may opt for the continuing of said exemption to the subsequent examinations:

Provided that such candidate shall be required to obtain a minimum of fifty per cent. marks in each of the remaining paper or papers of that Group or Unit in order to declare him to have passed in that Group or Unit.

The modalities for taking inputs for making an exemption permanent by the candidates and related guidelines for the same is given at https://www.icai.org/post/exam-sep-nov-2024 under the titleNovember 2024 Guidance Notes for Continuing the Exhausted Exemptions-Making Exemption/s Permanent.

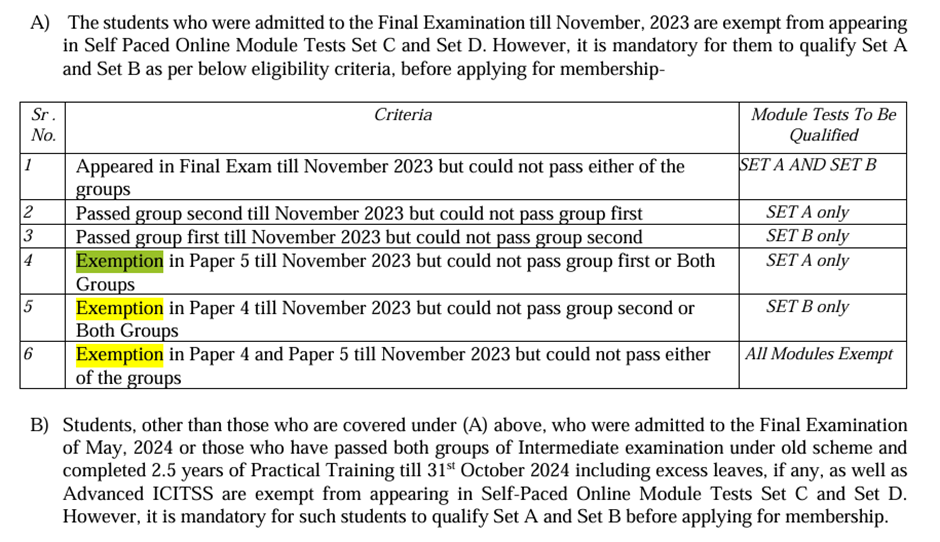

Candidates who have exemption in Paper 4 or Paper 5 of Final Examination Under Regulation 31 (iv) of the Chartered Accountants Regulations, 1988 will be permanently exempt from appearing in SET A or SET B respectively of Self paced Online Modules under Regulation 31 (v) of the Chartered Accountants Regulations, 1988.

Ready to Grow? Choose a Course That Fits Your Goals!

(v) Surrender of exemption.

It has been decided to allow the candidates to give option for surrendering the valid exemption already secured in toto in a paper/s on the basis of 60 percent marks, on the conditions that –

(i) exemption surrendered once shall be effective for all times to come for all the chances ( i.e. upto a maximum of three immediate next examinations or all remaining chance/s ) and under no circumstances the candidate shall be allowed to claim the surrendered exemption in future and,

(ii) On furnishing an affidavit to this effect on a non-judicial stamp paper of the value as applicable in the respective States. Candidates can exercise the option to surrender the exemption at any time during the currency of the validity of exemption but before the date prescribed for doing so i.e 20th September, 2024 in case of November 2024 Examinations.

A candidate who wants to surrender the valid exemption, in toto secured in a paper or papers on the basis of 60 percent marks in any of the immediate last three examinations as per the criteria given below-

1) May 2023

2) November 2023 and

3) May 2024 is advised in his own interest to write separately to the Director ( Examinations ) informing of his decision to surrender the exemption in toto along with original copy of the relevant Statement of Marks and subject name to enable the office to send further details in this regard and the proforma of the affidavit to be executed by the student. In addition to the above, candidates who had applied for Permanent Exemption earlier of May 2022 are also allowed to surrender the permanent exemption through the same procedure. Candidates should note that the surrender of exemption shall become effective only after furnishing the requisite affidavit and on issue of confirmation letter to this effect by the Institute.

Candidates are advised in their own interest to send the letter for surrender of exemption along with affidavit separately by REGISTERED POST/ SPEED POST to the Director ( Exams ) so as to reach on or before 20th September, 2024. The Institute shall not accept the responsibility for any such request not received till 20 th September, 2024.

Ready to Grow? Choose a Course That Fits Your Goals!

Fee Payment Process

Candidates are advised not to press the refresh or back button while the system is processing the fee payment. Doing so may cause the session to expire, potentially resulting in the deduction of the fee amount without the generation of the PDF form.

Retaining Important Documents

For their own reference, candidates should retain the “Notes for Information and Guidance of Applicants” and a photocopy of the application form until they receive their admit card.

Additionally, it has been noted that there will be no changes to the examination schedule even if any day of the examination is declared a public holiday by the Central or State Government.

Further conditions, if applicable, will be hosted on the ICAI website. Candidates are also advised to refer to the relevant announcements related to the Final Examination, available in the “Important Announcements” section under the “Board of Studies” on the ICAI website.

For more detailed information and updates, candidates should consult the provisions of the CA Regulations, 1988 and the ICAI website regularly.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates