The Indian government is likely to extend the deadline for linking Permanent Account Number (PAN) with Aadhaar by two to three months. A government official who is privy to the development disclosed that the Central Board of Direct Taxes (CBDT) could soon issue a notification to this effect, according to credible sources.

However, taxpayers will have to pay a fee for the extended period. The current deadline for PAN-Aadhaar linkage is March 31, 2023. To avoid incurring penalties, it is mandatory to link Aadhaar with PAN for filing Income Tax Returns (ITRs) and obtaining a new PAN.

The Central Board of Direct Taxes had already extended the deadline on March 30, 2022, by one year, setting a fee of Rs. 500 for up to three months from April 1, 2022, and Rs. 1,000 after that.

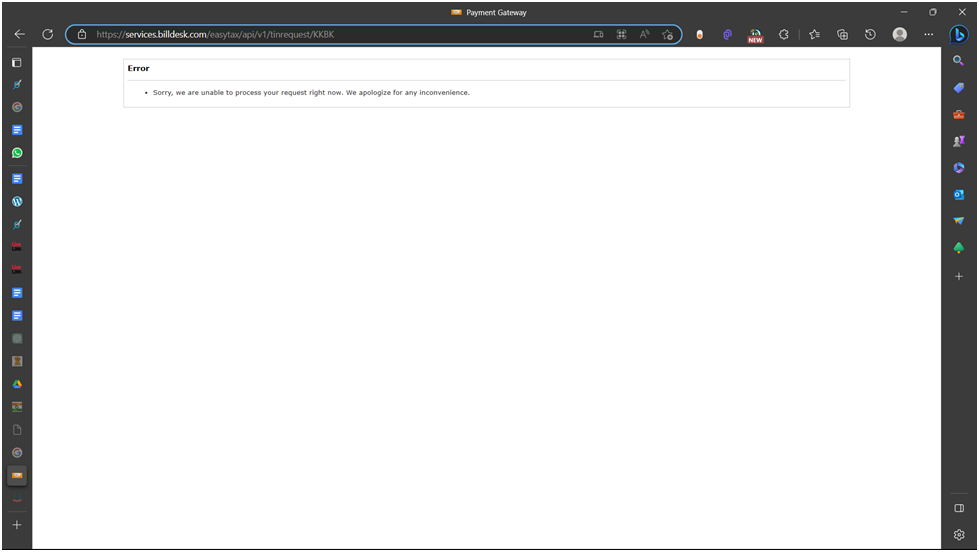

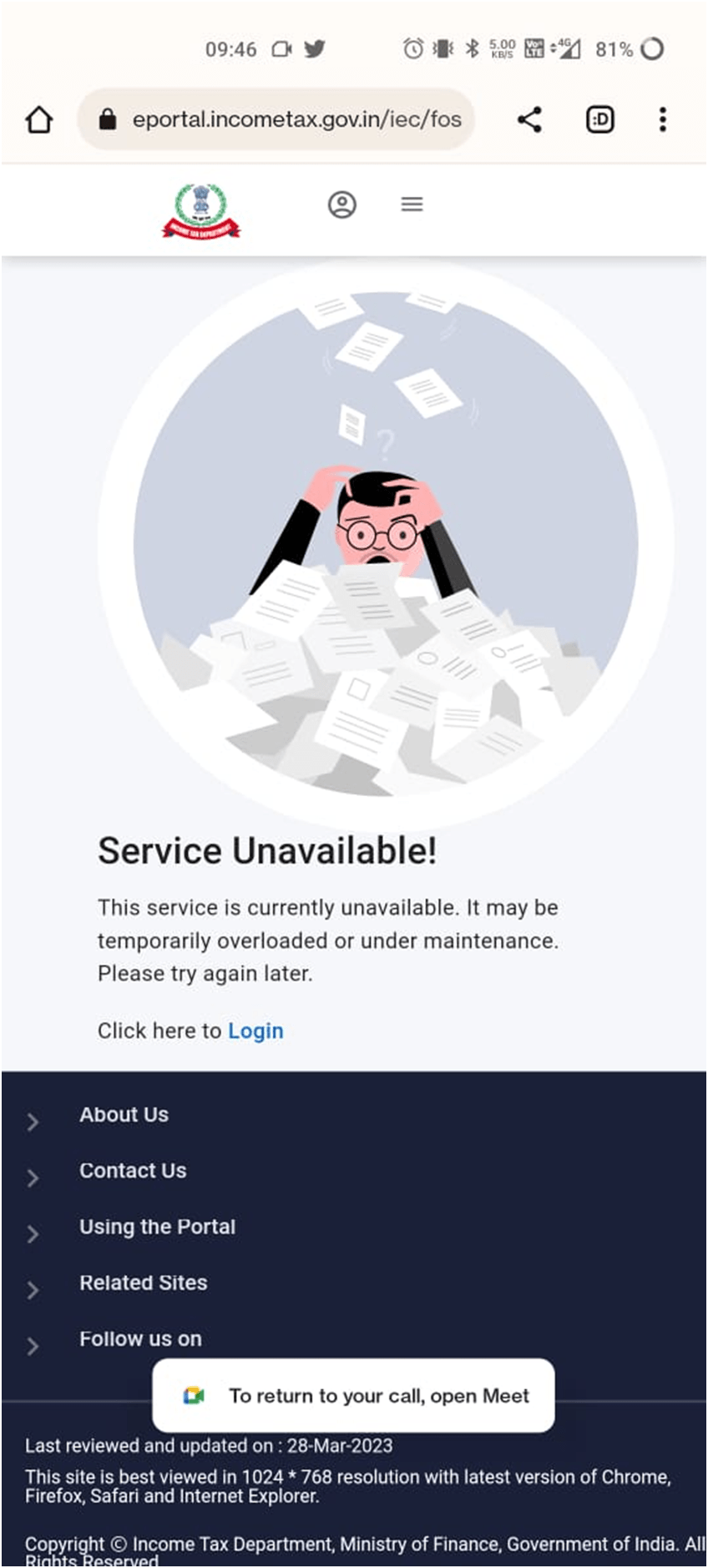

After March 31, 2023, the PAN of individuals who fail to link it with their Aadhaar will become inoperative, and all the consequences under the Income Tax Act will apply to such taxpayers, as per the existing situation. However, the portal is facing multiple glitches and stakeholders are having trouble linking the Aadhar Card with PAN Card.

As the deadline draws near, taxpayers across India are reporting technical glitches on the new income tax e-filing portal – incometaxindia.gov.in. Many have taken to social media to complain about issues with the payment and PAN-Aadhaar linking pages, highlighting that the portal is not working.

Read the comprehensive coverage in this matter reported at taxscan.in:

Income Tax Dept triggers Taxpayers by Daylight Loot in PAN-Aadhar Linking Late Fee Levy

Budget 2023: PAN will be used as a Common Identifier for Digital Systems

Non-Linking of Aadhaar with PAN may Result in Denial of Income Tax Benefits: CBDT Chief

Urgent Notice! PAN Cards unlinked to Aadhaar to become Inoperative Soon

PAN-Aadhaar Linking: Income Tax Dept Issues FAQs

Exemption from PAN-Aadhar Linking: Know if You Need to urgently Link or not

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates