The Institute of Chartered Accountants of India ( ICAI ) has recently conducted a comprehensive survey to assess the integration of artificial intelligence ( AI ) in Chartered Accountants ( CA ) firms. This survey, which gathered responses from approximately 1,100 ICAI members, provides valuable insights into the current state of AI usage within the CA community.

The survey results have been published to serve as a reference for Chartered Accountants, offering them a clearer understanding of how AI tools are being utilised in their profession.

According to ICAI, “This analysis will help in increasing awareness about AI tools and assist in the development and adoption of the ICAI Custom GPT for Chartered Accountants.”

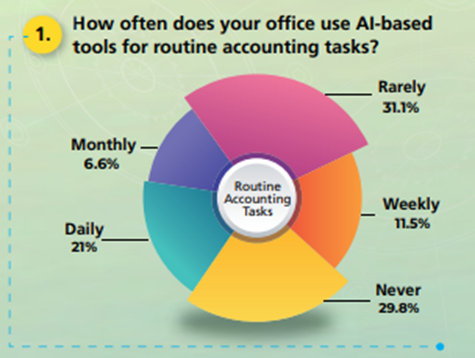

One of the key parameters of the survey was the frequency of AI tool usage for routine accounting tasks. Nearly half of the respondents reported rarely using AI-based tools, and 29.8% stated they never use such tools. However, 21% of the respondents indicated they use AI tools daily, highlighting a mixed level of adoption within the industry.

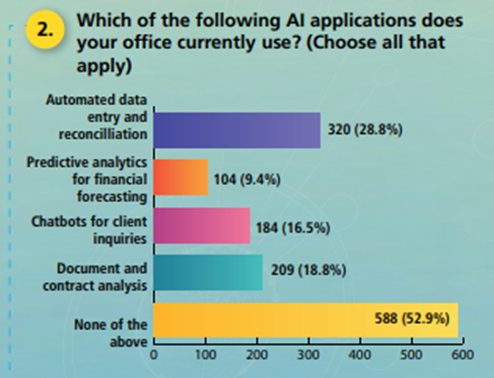

The survey also explored the types of AI applications currently in use. The responses indicated that while automation and other AI applications are gaining traction, there is still a large untapped potential for AI in CA firms. This suggests a growing interest in AI, but also a need for more widespread implementation.

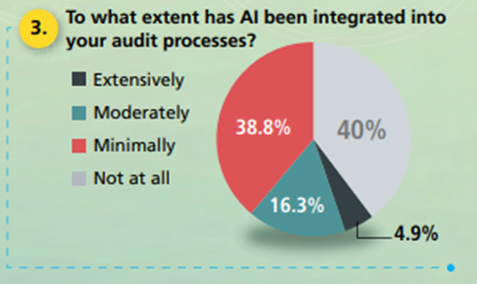

When it comes to audit processes, the survey revealed that the majority of firms have not yet integrated AI. However, 60% of the respondents use AI tools to varying degrees—extensively, moderately, or minimally. This points to a potential shift, with non-users possibly moving towards AI adoption in the near future.

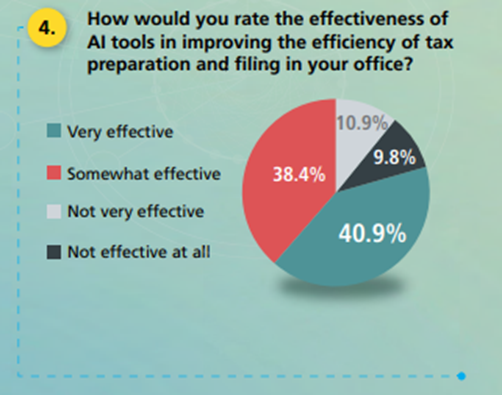

The effectiveness of AI tools in improving tax preparation and filing efficiency was also assessed. The responses indicated a wide range of experiences, likely due to differences in tool implementation and the specific technologies employed. This variability suggests that while AI can significantly improve efficiency, its success depends on how it is applied.

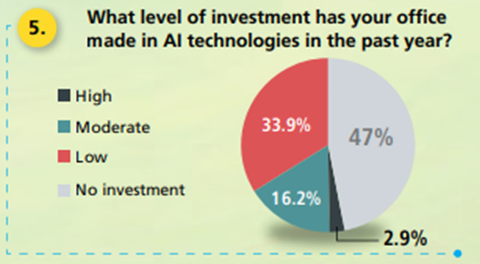

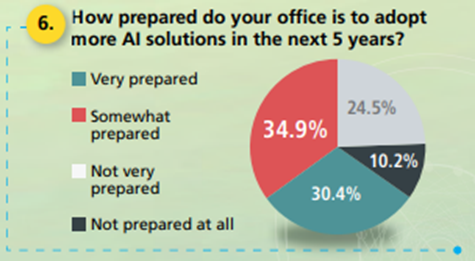

Investment in AI technologies over the past year was another focus area. More than half of the respondents feel prepared to adopt more AI solutions in the next five years, indicating an encouraging openness to further AI integration. This readiness highlights a positive outlook towards embracing AI innovations.

The survey identified several barriers to further AI adoption, with lack of knowledge or skills emerging as the most significant. This underscores a crucial need for educational initiatives to bridge the knowledge gap. Other barriers, such as cost constraints and benefit uncertainties, could be addressed through initiatives like workshops and seminars that demonstrate AI’s practical value.

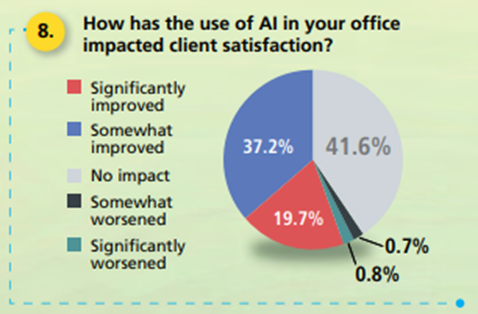

AI’s impact on client relations was also explored, with a substantial number of respondents indicating positive or improved impacts. This suggests that with proper utilisation, AI has the potential to significantly enhance client relations.

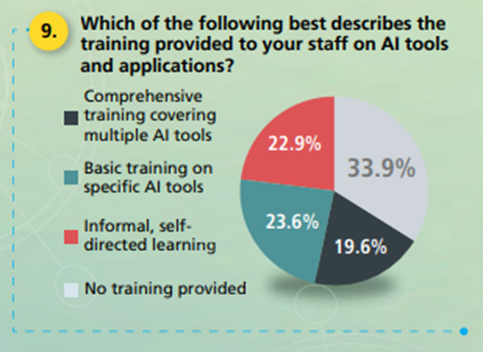

Training on AI tools and applications is another critical aspect. About 19.6% of respondents indicated providing comprehensive training to their staff, and 23.6% reported offering basic training. This shows rising awareness among firms about AI’s potential. However, the overall response indicates a need for enhanced and more comprehensive AI training across the sector to fully realise AI’s benefits.

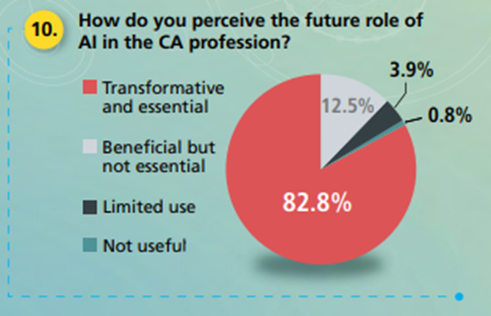

Finally, the future role of AI in the CA profession was examined. A strong majority (82.8%) of respondents believe that AI will play a crucial and transformative role, reflecting high expectations for AI in reshaping the profession. This optimism suggests that the CA community is ready to embrace AI’s transformative potential, paving the way for a more technologically advanced future.

The ICAI’s article on the survey concluded that “The survey depicts a scenario where optimism about AI’s transformative potential is mixed with inclination to adopt AI, which faces significant adoption barriers. Based on the learnings from the survey, the ICAI will be moving towards building a cohesive ecosystem to improve adoption of AI to fully realize its transformation potential for finance and accounting, Through targeted training efforts, facilitating access to AI tools in collaboration with the industry, and demonstrating effective AI use cases, we aim to encourage members to explore and utilize AI, paving the way for more widespread and effective AI integration.”

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates