In India, the personal tax is governed by the Income Tax Act, 1961. It has mandated certain persons carrying businesses and professionals to undergo a tax audit under Section 44AB of the Income tax legislation. There are different types of income tax audit forms which have to be furnished by different classes accordingly. A tax audit is the review of accounts of the company or professionals who have been categorised for compulsory audit by an independent body.

SECTION 44AB – INCOME TAX AUDIT PROVISION

The Section 44AB of Income Tax Act completely deals with the audit of accounts of certain persons carrying on business or profession. A Chartered Accountant conducts a thorough audit of the taxpayer’s accounts to ensure compliance with tax regulations. According to the section ‘Every person’ carrying on business or profession shall get their accounts audited and furnish the audit report if:

Get the Copy of Reporting under FORM 3CD – A Ready Reckoner – Click here.

Exemptions apply if:

FORM 3CA

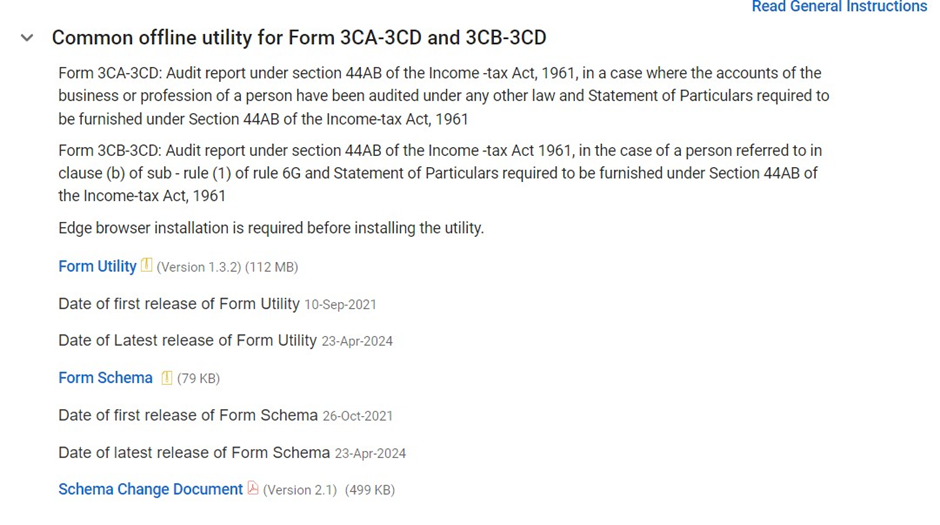

Form 3CA is used when a business or profession is required to have its accounts audited under another law, such as the Companies Act, 2013, or the Co-operative Societies Act, 1960. The form is available on the income tax department website as an offline utility. The department has updated the utility in April 2024 itself.

Details to be Filled in Form 3CA

Assessee’s Name and PAN

Name of the Auditor/CA ( Firm or Individual )

Concerned Act ( e.g., Companies Act, Co-operative Societies Act )

Date of the Audit and Audit Report

Period of the Income and Expenditure Account or Profit and Loss Account ( Start and End Date )

Date of the Balance Sheet Used to Perform the Audit

Declaration that Form 3CD has been Attached Along with the Audit Report

Qualifications/Audit Observations Found in the Details Associated with Form 3CD

Date and Place of Signing the Audit Report

Auditor’s Details: Name, Address, and Membership Number

Seal and Stamp of the Auditor

FORM 3CB

Form 3CB is utilised when a business or profession is not obligated to have its accounts audited under any other law. This form is an important part of the income tax audit process for businesses that do not fall under the mandatory audit requirements stipulated by other regulations.

Details to be Filled in Form 3CB

HOW TO DOWNLOAD FORM 3CA AND 3CB FORMS

The Common offline utility can be accessed on the income tax website. Go to the downloads part of the income tax website. Further click on the income tax forms. There you can access the utilities for all income tax forms. The latest release of the utility and the scheme was on 23rd April 2024.

DUE DATE FOR FILING FORM 3CA AND FORM 3CB

The deadline for submitting Form 3CA and Form 3CB is September 30th of the relevant assessment year, unless an extension is approved. For the fiscal year 2023-2024, the income tax audit report must be filed by September 30th, 2024. These forms are necessary for tax audits mandated under Section 44AB of the Income Tax Act, 1961, which applies to specific businesses and professionals.

PENALTIES OR CONSEQUENCE FOR NOT FILING AUDIT REPORT FORM 3CA AND 3CB

If Form 3CA or Form 3CB is not filed, several penalties may be imposed under Section 271B. The minimum penalty is 0.5% of the total sales, turnover, or gross receipts, while the maximum penalty can reach up to Rs. 1,50,000. However, no penalty will be levied if the taxpayer can demonstrate a reasonable cause for the non-compliance. Additionally, the return of income may be deemed defective, and prosecution proceedings could also be initiated.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates