Under the Income Tax Rules, Form 16 is the certificate of deduction of tax at source and issued on deduction of tax by the employer on behalf of the employees. These certificates provide details of TDS / TCS for various transactions between deductor and deductee. It is mandatory to issue these certificates to Taxpayers.

Form 16 is a certificate issued to salaried individuals from their employer when he deducts tax from the employee salary. In simple words, it is an acknowledgment which states your deducted tax has been deposited with the income tax department.

Form 16 is an important document that is issued in accordance with the provisions of the Income Tax Act,1961. Form 16 contains details of the amount of tax deducted at source (TDS) on salary by your employer along with the salary breakup for the financial year. In a nutshell, it could be said that Form 16 is a certificate of proof of the TDS deducted & deposited by your employer.

For Example, the income from your salary for the financial year is more than the basic exemption limit of Rs. 2, 50, 000. Then, in this case, your employer is required to deduct TDS on your salary and deposit it with the government. When Form 16 is provided to an employee by their employer, it is considered as a source of proof of filing their Income Tax Returns. And if your income does not fit the basic exemption limit, the employer does not deduct any TDS in that case.

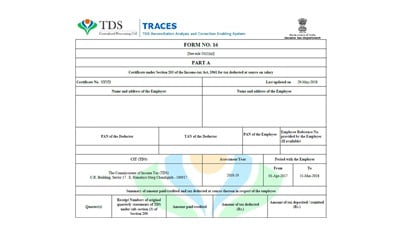

Form 16 has mainly 2 components namely Part A and Part B.

This part of income tax form 16 covers employer, employee, TDS payment details. It shows quarter-wise details of your tax deposited with the government.

The employer generates and downloads this part of Form 16. Before issuing this certificate, the employer will authenticate for the correctness of its contents. Form 16 Part A can be downloaded from the TRACES.

It is vital for you to get a separate Part A of Form 16 for the period of employment if you have changed your job. Following are the components of Part A of Form 16:

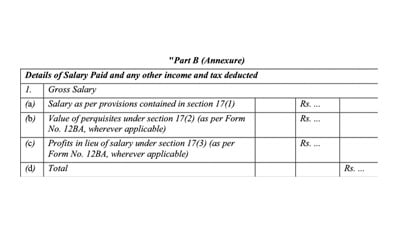

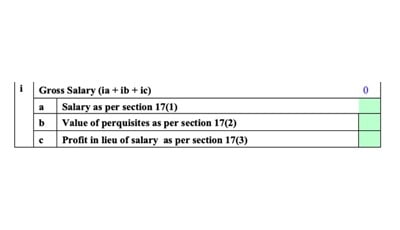

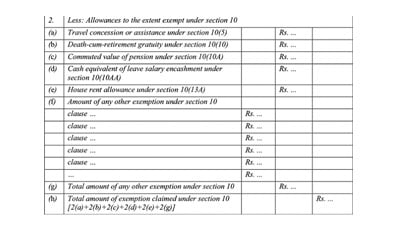

This part shows the detailed computation of Income, on the basis of which tax is being calculated and deducted by your employer. It contains the breakup of the salary earned by you, various deductions, exemptions (if any), and the tax computation after considering all the items on the basis of current tax slab rates.

It contains the following information :

Gross contains three parts namely:

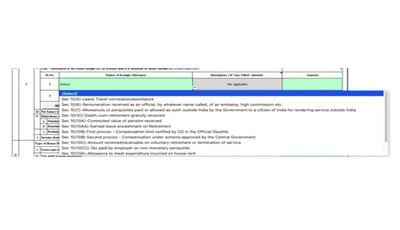

The list of allowances are as follows: