The Income Tax Department has launched its new e-filing portal (www.incometax.gov.in) on June 7, replete with new features which are expected to make the ITR filing process much easier and faster.

The Income Tax Department notified all the existing taxpayers by sending a text to their registered numbers. “Dear Taxpayer, The Income Tax Department is happy to inform you of the launch of its new e-filing portal http://www.incometax.gov.in on 7th June, 2021.”

Overview of the New features that the new e-filing portal is offering

The new website will enable a new online tax payment system with multiple new payment options using net banking, UPI, credit card and RTGS/NEFT from any account of the taxpayer in any bank, for easy payment of taxes.

By Clicking on the application tab takes an individual to view guidance on how to file ITRs and applicable forms for the same. Deductions, refund status, tax slab and other related information are also present there.

All interactions and uploads or pending actions will be displayed on a single dashboard for follow-up action by taxpayer

Free of cost ITR preparation software available with interactive questions to help taxpayers for ITRs 1, 4 (online and offline) and ITR 2 (offline) to begin with; Facility for preparation of ITRs 3, 5, 6, 7 will be made available shortly

Taxpayers will be able to proactively update their profile to provide certain details of income including salary, house property, business/profession which will be used in pre-filling their ITR. Detailed enablement of pre-filling with salary income, interest, dividend and capital gains will be available after TDS and SFT statements are -uploaded (due date is June 30th, 2021)

New call center for taxpayer assistance for prompt response to taxpayer queries. Detailed FAQs, User Manuals, Videos and chatbot/live agent also provided.

Functionalities for filing Income Tax Forms, Add tax professionals, Submit responses to Notices in Faceless Scrutiny or Appeals would be available.

Quick runthrough of the Income-Tax e-filing 2.0 Portal

The new e-filing portal is built on the pillars of Speed, Accuracy, Convenience and usability.

On top you will find the tabs to access persona based help content namely Home, Individual, Company, Non-Company, Tax-Professional and Others, Downloads and help.

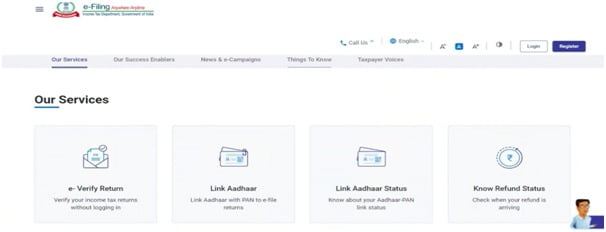

As you scroll down, you can see some of the services namely e-verify return, Link Aadhar, Link Aadhar Status, Know you refund status and ITR Status.

When you further scroll down you will see enhanced and user friendly help section wherein you will get FAQs, User Manuals, Videos, which will help you learn how to avail various services available on portal.

Additionally, to this chatbot and helpline is available for your guided assistance.

In order to avail all the services of the portal you need to Login to the portal and if you are not the Registered user, then you need to register on the portal.

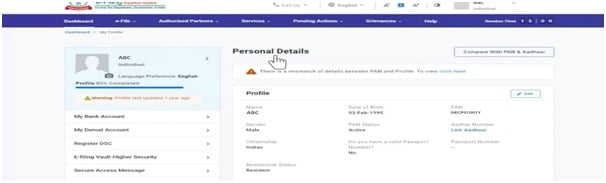

On top you will find the tabs to access at the dashboard post login namely E-file, Authorised Partners, Services, Pending Actions, Grievances, and help.

You can view, edit and update your profile, your personal details, your contact details must be updated properly so as to ensure hassle free communication between the taxpayer and Income tax department.

On the left you will find the things for the purpose of profile completion so that you can make the best use of the portal and receive timely communication from the department. You can access the portal in various regional languages.

The new mobile app will be available shortly wherein you will be able to avail various tax related services in one go.

Support our journalism by subscribing to Taxscan AdFree. We welcome your comments at info@taxscan.in