“A nation may do without its millionaires and without its capitalists but a nation can never do without its labour.”- Mahatma Gandhi

The Labour force, the first step of the economy, constitutes a major section of society. Therefore, to protect the rights and to safeguard the interest of this driving force of the economy, society needs proper legislation for labors.

Primarily, Labour Legislation establishes following three key elements:

•Reminder about Constituional and Social guarantee of Fundamental principles and rights at work

•Framing a hormonius structure of Industrial relation on work place democracy

•Legal system to form a productive economy to stregthen worker and employer relationship

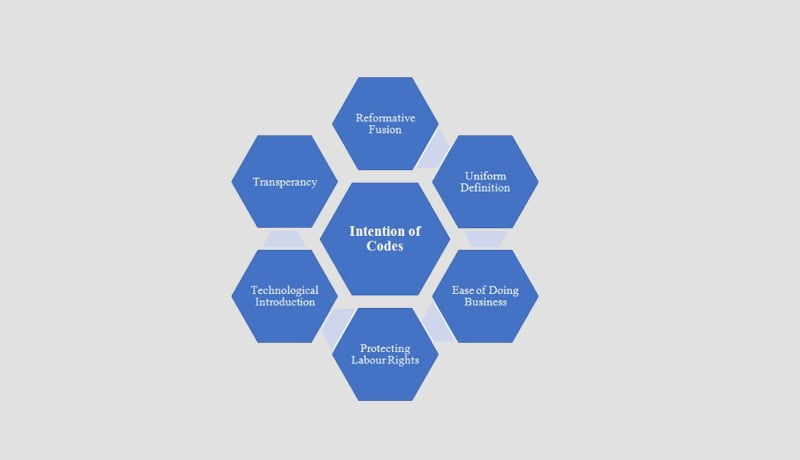

India had around 44 Central Administered Labour Laws and more than 100 State-administered Labour Laws. All labour laws have running around the socio-economic requirement vis-à-vis requirement of the labour force. However, due to so many legislations considering different localities, industries have been somehow facing difficulties in complying with each and every law and running parallel with business. Therefore, to lessen the difficulties faced by Industries, keeping the labour rights in balance and considering the changing socio-economic situation of the labour force, the Government of India, to ease in doing the business, categorised 44 Central Laws in 4 Codes.

This Article mainly focuses on understanding the background of Labour Laws in India, recent reform in Labour Laws and opportunities available to Company Secretaries.

A. Labour Legislation and World War-1:

Historical study suggest that the seed of Socialistic Labour Legislation is very much sown with the emergence of World War-1. World War-1 or First World War or WW-1 originated in Europe from 28th July 1914 and lasted till 11th November 1918. WW1 contemporarily known as the “war to end all wars”. It caused massive casualties, estimated around 20 million deaths, including military and civilians who were directly linked to War. Pre-war phase and Wartime caused very tight labour crisis, a slave like situation for war-material mass production, long working hours, hazardous to very hazardous working condition of labours and like.The industrialists and belligerent states, by amending or introducing laws, maximized labour for the purposes of increasing productivity.Because of such reasons, organizations like Socialistic Party, Industrial Workers of the Word (IWW), launched movement for social change. Penned by socialist Hulet M. Wells, the Seattle Central Labor Council (representing 25,000 workers) passed an antiwar resolution the day after European fighting was declared in 1914. It stated:

“Whereas, the appalling loss of life which will inevitably result…will fall with crushing force on the working class alone, while the kings, capitalists, and aristocrats remain in safety, and

Whereas, no possible outcome of such an international war can benefit to any extent whatever the workers, whose enemies are not the workers of other nations, but the exploiting class of every nation…

Therefore, as representatives of the organized working class, we declare the European war to be an international crime and a horror for which there is no parallel in savagery… To all those workers of Europe who have resisted the war craze we extend our sympathy and respect, and we pledge our efforts against any attempt to draw our own country into a foreign war.”[1]

There was multiple protest all across globe in response to state efforts to maximize production, structural changes in industries, and declining real wages, safety and living conditions over the course of the war. Some are Seattle General Strike, Hunger Strike in Austria, Strikes in Russia, Germany.

B. International Labour Organization

WW1 ended with the signing of the Armistice of Compiègne on 11th November 1918. The peace treaty was finally signed on 28th June 1919 known as the Treaty of Versailles. Through Part XIII of the said Treaty, International Labour Organization (“ILO”) was created as an agency of the League of Nations. In 1946, after the demise of the League of Nations, the ILO became the first specialized agency associated with the United Nations. ILO is only the tripartite UN Agency bringing Government, Employer, and worker to the same table in fostering social and economic progress.

C. India

India has been founding member of ILO since 1922 and it has permanent seat in ILO Governing Body. First ILO office was set-up in India in 1928.

The legal regime for Labourers in India has a history of more than 150 years. Start from the Apprentice Act, 1850 followed by the Factories Act, 1881 and the first State Act was the Bombay Trade Disputes (and Conciliation) Act, 1934 and henceforth. Indian Labour Law is indirectly connected with the Indian Independence Movement. Few events which laid the foundation for better Labour Laws in India are Buckingham and Carnatic Mills Strike happened in 1921, Binny Mill Strike happened in 1926, South Indian Railway Strike happened in 1928, Meerut Conspiracy Case happened in 1929.

Like other legislation in India, Labour Laws also derive their origin or recognition from the Constitution of India. Articles 16, 19, 23 and 24 of Part III and Articles 39, 41, 42, 43, 43A and 54 of Part IVof Constitution of Indiapreside over the need for protecting and safeguarding the interest of labour as human beings keeping in line with the Fundamental Rights and Directive Principles of State Policy. Before outlining any legislation for Labours, the Centre and the State, as the case may be, has to pass the litmus test of Part III and Part IV parallelly.

Our judiciary has been very stern on maintaining balance between Part III and Part IV of the Constitution of India.

Fundamental Rights and Directive Principles together constitute the core of our Constitution and combine to form its conscience. Anything that destroys the balance between the two parts will ipso facto destroy an essential element of the basic structure of our Constitution. (Minerva Mills v. Union of India, AIR 1980 SC 1789).

In Daily Rated Casual Labour v. Union of India (1987 AIR 2342), it has been held that classification of employees into regular employees and casual employees for the purpose of payment of less than minimum pay is violative of Articles 14 and 16 of the Constitution. It is also opposed to the spirit of Article 7 of the International Covenant of Economic, Social and Cultural Rights 1966. The government cannot take advantage of its influential position. The government should act as a model employer.”

In the case of Gopika Ranjan Choudhary v. Union of India JT 1989 (4) SC 173 it was held that recommendation of The Third Central Pay Commission (1973) two different pay scales with respect to the ministerial staff of the force, those who are working at Headquarter and those who are working at Battalions/ Units, was discriminatory and vocative of Article 14 and there was no difference between staff working at the headquarters and battalion and the service of Battalion is transferrable to headquarters.”

Labour Laws is mainly subject to Concurrent List (List-III of Seventh Schedule), though it is placed in all three lists of the Constitutions. Important Entry lists are as follows:

| Entry No. | Particulars |

| 55 (Union List) | Regulation of labour and safety in mines and oil fields |

| 22 (Concurrent List) | Trade Unions; industrial and labour disputes. |

| 61 (Union List) | Industrial disputes concerning Union employees |

| 23 (Concurrent List) | Social Security and insurance, employment and unemployment. |

| 65 (Union List) | Union agencies and institutions for “Vocational …training…” |

| 24 (Concurrent List) | Welfare of labour including conditions of work, provident funds, employers “invalidity and old age pension and maternity |

Form the Constitutional Structure, the Centre and the States has the power to frame labour legislation as per requirement. The basic notion of keeping Labour part mainly in the Concurrent list is the divergence of the socio-economic and cultural environment in every region. Accordingly, Centre and States make laws as per the requirements and make changes as per changing environment. Central Acts delegates power to make Rules to States also as per their local need, like Section 38 of Industrial Dispute Act, Section 26 of Payment of Wages Act and others.

The first codification of Indian Labour laws happened in 1994 by National Labour Law Association (“NLLA”). That code has always been in the draft and known as The Indian Labour Code 1994 (“1994 Code”). NLLA was established in 1980 as Society with the objective to research the relationship between Labour, Employer and Government. It acts as one of the Consultative Body for the Ministry of Labour and Employment (“MoLE”). 1994 Code was very much appreciated in the Report of the 2ndNational Commission on Labour (“SNCL Report”) submitted to the then Prime Minister Late Atal Bihar Vajpayee in the year 2002 by Mr Ravindra Varma, Chairman of the National Commission, Ministry of Labour, Government of India. In SNCL Report, Commission agreed on the grouping structure of the 1994 Code into five parts (i) industrial relations, (ii) wages, (iii) social security, (iv) safety and (v) welfare and working conditions. Further to submission of SNCL Report, in several Indian Labour Conferences (“ILC”), from 38th ILC, numerous discussions among Central Government, State Governments, Employers through various Trade Chambers/ Associations, Labour through Trade Unions/ Associations and eminent experts happened. Several amendments were also made. In between other ILC, several other recommendations placed before the Government. Like, in 2006, Planning Commission constituted a Working Group on “Labour Laws and other Labour Regulations” whose report was mentioned in the Eleventh Five Year Plan (2007-2012). In the report, Working Group focused primarily on the dynamic context of socio-economic situation and Industrialization in India vis-à-vis the global scenario. They were of the view that laws need to be reviewed from time to time and hence labour laws should be transformed from multiple and complex structures to simple form in order to bring them in tune with the emerging needs of the economy such as attaining higher levels of productivity & competitiveness, increasing employment opportunities, attaining more investment both domestic and foreign etc. The same context drove by the Working Group constituted for Twelfth Five Year Plane (2012-2017). In the Report of Working Group on Labour Laws & Other Regulations for the Twelfth Five Year Plan, 44 Central Laws have been categorised as follows:

| Sl. No. | Name of the Act |

| (a) Labour laws enacted and enforced by Central Government | |

| 1 | The Employees’ State Insurance Act, 1948 |

| 2 | The Employees’ Provident Fund and Miscellaneous Provisions, Act, 1952 |

| 3 | The Dock Workers (Safety, Health and Welfare) Act, 1986 |

| 4 | The Mines Act, 1952 |

| 5 | The Iron Ore Mines, Manganese Ore Mines and Chrome Ore, Mines Labour Welfare (Cess) Act, 1976 |

| 6 | The Iron Ore Mines, Manganese Ore Mines and Chrome Ore Mines Labor Welfare Fund Act, 1976 |

| 7 | The Mica Mines Labour Welfare Fund Act, 1946 |

| 8 | The Beedi Workers Welfare Cess Act, 1976 |

| 9 | The Limestone and Dolomite Mines Labour Welfare Fund Act, 1972 |

| 10 | The Cine Workers Welfare (Cess) Act, 1981 |

| 11 | The Beedi Workers Welfare Fund Act, 1976 |

| 12 | The Cine Workers Welfare Fund Act, 1981 |

| (b) Labour laws enacted by Central and enforced by both the Central as well as the State Governments | |

| 13 | The Child Labour (Prohibition and Regulation) Act, 1986. |

| 14 | The Building and Other Constructions Workers’ (Regulation of Employment and Conditions of Service) Act, 1996.) |

| 15 | The Contract Labour (Regulation and Abolition) Act, 1970. |

| 16 | The Equal Remuneration Act, 1976. |

| 17 | The Industrial Disputes Act, 1947. |

| 18 | The Industrial Employment (Standing Orders) Act, 1946. |

| 19 | The Inter-State Migrant Workmen (Regulation of Employment and Conditions of Service) Act, 1979. |

| 20 | The Labour Laws (Exemption from Furnishing Returns and Maintaining Registers by Certain Establishments) Act, 1988 |

| 21 | The Maternity Benefit Act, 1961 |

| 22 | The Minimum Wages Act, 1948 |

| 23 | The Payment of Bonus Act, 1965 |

| 24 | The Payment of Gratuity Act, 1972 |

| 25 | The Payment of Wages Act, 1936 |

| 26 | The Cine Workers and Cinema Theatre Workers (Regulation of Employment) Act, 1981 |

| 27 | The Building and Other Construction Workers Cess Act, 1996 |

| 28 | The Apprentices Act, 1961 |

| (c) Labour laws enacted by Central Government and enforced by the State Governments | |

| 29 | The Employers’ Liability Act, 1938 |

| 30 | The Factories Act, 1948 |

| 31 | The Motor Transport Workers Act, 1961 |

| 32 | The Personal Injuries (Compensation Insurance) Act, 1963 |

| 33 | The Personal Injuries (Emergency Provisions) Act, 1962 |

| 34 | The Plantation Labour Act, 1951 |

| 35 | The Sales Promotion Employees (Conditions of Service) Act, 1976 |

| 36 | The Trade Unions Act, 1926 |

| 37 | The Weekly Holidays Act, 1942 |

| 38 | The Working Journalists and Other Newspapers Employees (Conditions of Service) and Miscellaneous Provisions Act, 1955 |

| 39 | The Workmen’s Compensation Act, 1923 |

| 40 | The Employment Exchange (Compulsory Notification of Vacancies), Act, 1959 |

| 41 | The Children (Pledging of Labour) Act 1938 |

| 42 | The Bonded Labour System (Abolition) Act, 1976 |

| 43 | The Beedi and Cigar Workers (Conditions of Employment) Act, 1966 |

| 44 | The Unorganized Workers’ Social Security Act, 2008 |

In 43rd, 44th and 45th ILC major recommendations were advised to the Central Government for amalgamation of present abundance of labour laws into four codes.

Federation of Indian Chambers of Commerce & Industry (“FICCI”) in association with All India Organization of Employee (“AIOE”) presented its “Labour Law Policy Reform” in 2014 (“FICCIPaper”). In FICCIpaper, it was stated that existing labour laws are enacted 40 to 70 years back largely concentrated in and around the manufacturing sector and the service sector is barely touched, which presently account for more than 55% of Gross Domestic Product. Further, present laws protect only a handful of 6-8 per cent of the total workforce. FICCI paper suggested shifting the labour laws from Concurrent List to State List and also opined to have four sets of labour laws.

Finally, in 46th ILC happened between July 20 and July 21, 2015, the then Minister of State (Independent Charge), Labour & Employment, Mr. BandaruDattatreya, in auspicious presence of the Hon’ble Prime Minister of India stated that Ministry of Labour and Employment is working towards finalization of four new labour codes.

After considering several suggestions, requests, Working Group finding, Industry Requirement, ILC recommendations, as briefed in above parts, the Central Government tabled four codes subsuming 29 (twenty-nine) Central Labour Laws before the Parliament, which has been passed by the Parliament and consented by the Hon’ble President of India.

| Amalgamated Acts | Codes (Act No.) (President assent date) |

| (a) The Payment of Wages Act, 1936, (b) the Minimum Wages Act, 1948, (c) the Payment of Bonus Act, 1965; and (d) the Equal Remuneration Act, 1976 | The Code on Wages, 2019 (29 of 2019) (8th Aug 2019) {“WC”} |

| (a) the Trade Unions Act, 1926; (b) the Industrial Employment (Standing Orders) Act, 1946; and (c) the Industrial Disputes Act, 1947, | The Industrial Relations Code, 2020 (35 of 2020) (28th September 2020) {“IRC”} |

| (a) The Employee’s Compensation Act, 1923; (b) The Employees’ State Insurance Act, 1948; (c) The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952; (d) The Employment Exchanges (Compulsory Notification of Vacancies) Act, 1959; (e) The Maternity Benefit Act, 1961; (f) The Payment of Gratuity Act, 1972; (g) The Cine-Workers Welfare Fund Act, 1981; (h) The Building and Other Construction Workers’ Welfare Cess Act, 1996; (i) The Unorganised Workers’ Social Security Act, 2008. | The Code on Social Security, 2020 (36 of 2020) (28th Sept 2020) {“CSS”} |

| (a) The Factories Act, 1948; (b) The Plantations Labour Act, 1951; (c) The Mines Act, 1952; (d) The Working Journalists and other Newspaper Employees (Conditions of Service) and Miscellaneous Provisions Act, 1955; (e) The Working Journalists (Fixation of Rates of Wages) Act, 1958; (f) The Motor Transport Workers Act, 1961; (g) The Beedi and Cigar Workers (Conditions of Employment) Act, 1966; (h) The Contract Labour (Regulation and Abolition) Act, 1970; (i) The Sales Promotion Employees (Conditions of Service) Act, 1976; (j) The Inter-State Migrant Workmen (Regulation of Employment and Conditions of Service) Act, 1979; (k) The Cine-Workers and Cinema Theatre Workers (Regulation of Employment) Act, 1981; (l) The Dock Workers (Safety, Health and Welfare) Act, 1986; (m) The Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996. | The Occupational Safety, Health And Working Conditions Code, 2020 (37 of 2020) (28th Sept 2020) {“OSH”} |

| Some of common Regime of Four Codes | |

| Appropriate Government (AG) | For PSUs, Central Government (CG) will act as AG.For all regulated/ controlled industry, CG will be AG.For rest, State Government (SG) will be AG. |

| Power to Exempt establishments | IR empowers AG to exempt new Industrial Establishments or any class to exempt in public interest.OSH permits AG to exempt any establishment. OSH also santion SG to exmept new factories or class for ease of doing business. |

| Delegated Legislation | Codes has importanly delegated AG to frame rules at many aspects. |

| Inspector-cum-Facilitator | Under SS, IR and OSH, Labour Inspector has ben assigned with additional duty as Facilitator.Inspector has to facilitate employer in complaince part first. Later, he will inspect the compaliance |

| Dispute Resolution | Civil Courts has been barred from taking up matter under Codes.Parties are advised to come to tribunal by its own unless authorised to someone else.Advocates have only been allowed to appear before Tribunal after being appointed so and consented by other party and Tribunal. |

[1]Quoted in Harvey O’Connor, Revolution in Seattle: A Memoir (New York: Monthly Review Press, 1964)

Support our journalism by subscribing to Taxscan AdFree. We welcome your comments at info@taxscan.in