The “Bank Accounts” section under the “Amendment of Registration Non-Core Fields” in the GST portal has been updated with a new interface by the GST Network ( GSTN ).

The Goods and Services Tax Network ( GSTN ) under the Central Board of Indirect Taxes and Customs ( CBIC ) has issued an important advisory for all Goods and Services Tax ( GST ) taxpayers about the mandatory requirement of furnishing valid bank account details before filing GSTR-1 or using the Invoice Furnishing Facility ( IFF ). This requirement, enforced under Rule 10A of the Central Goods and Services Tax (CGST) Rules, 2017, will come into effect from September 1, 2024, as per Notification No. 38/2023 – Central Tax.

Read More: GSTN issues Advisory for furnishing bank account details before filing GSTR-1/IFF

The section focuses on the validation and updating of bank account details, which are essential for GST registration and compliance.

Get a Copy of Analysis of GST Returns (Interlinking of returns for compliance enhancement), Click here

Key Features of the Updated Interface:

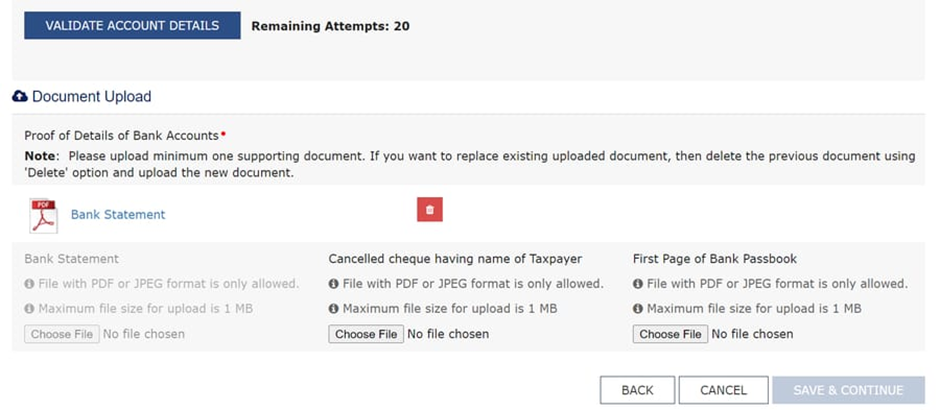

1. Document Upload Requirements:

– Users are required to upload proof of their bank account details.

– Acceptable documents include:

– Bank Statement

– Cancelled Cheque (bearing the taxpayer’s name)

– First Page of Bank Passbook

– The documents must be in PDF or JPEG format, with a maximum file size of 1 MB.

Get a Copy of Analysis of GST Returns (Interlinking of returns for compliance enhancement), Click here

2. User Actions:

– Users can choose the type of document they wish to upload by selecting the appropriate option.

– The interface provides a “Choose File” option to upload the necessary document from the user’s device.

3. Validation Process:

– After uploading the document, users can validate their account details by clicking the “Validate Account Details” button.

– The number of remaining attempts for validation is also displayed, with the example in the image showing 20 attempts left.

4. File Management:

– Users can replace an existing uploaded document by deleting the previous one and uploading a new document.

– There’s a clear option to delete uploaded files if corrections are necessary.

Get a Copy of Analysis of GST Returns (Interlinking of returns for compliance enhancement), Click here

5. Navigation Controls:

– Users can navigate through the process using “Back,” “Cancel,” and “Save & Continue” buttons, ensuring they can review or abort the process as needed.

This new interface streamlines the process of updating bank account details in the GST registration, making it more user-friendly and transparent. It also ensures that only valid and up-to-date bank details are associated with a taxpayer’s GST profile, which is crucial for accurate tax administration.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates