The CBDT ( Central Board of Direct Taxes ) has amended the Income Tax Form 27Q. The official notification was conveyed through e-gazette vide notification no. G. S. R. 2153(E) dated 31st March 2024. The changes shall come into force on 1st July 2024.

Form 27Q

The Form 27Q is the Quarterly statement of deduction of tax ( TDS ) under sub‐section (3) of Section 200 of the Income‐tax Act, 1961 in respect of payments other than salary made to non‐residents. It covers income payments to foreigners and NRIs, excluding salary income.

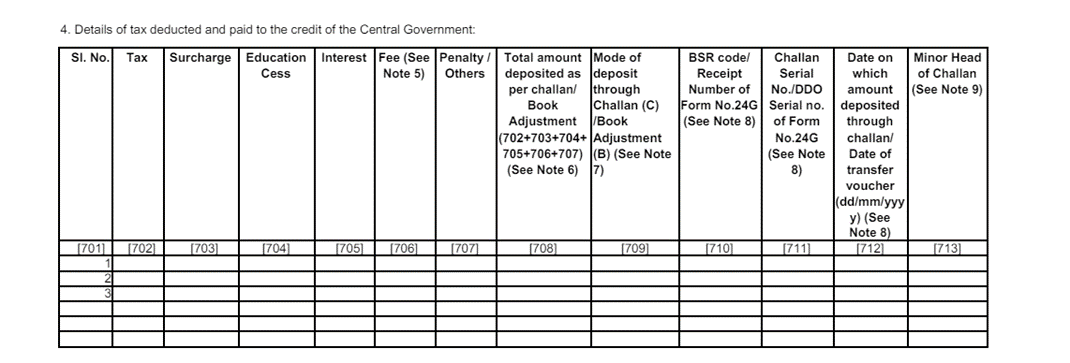

The TAN, PAN, Name of Deductor, TAN Registration No., Address, Particulars of the person responsible for deduction of tax, and the address of such person should be given. These are the basic details. The below given image is the columns to be filled with regards to the tax deducted and paid to the credit of the government.

Amendments in Form 27Q

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates