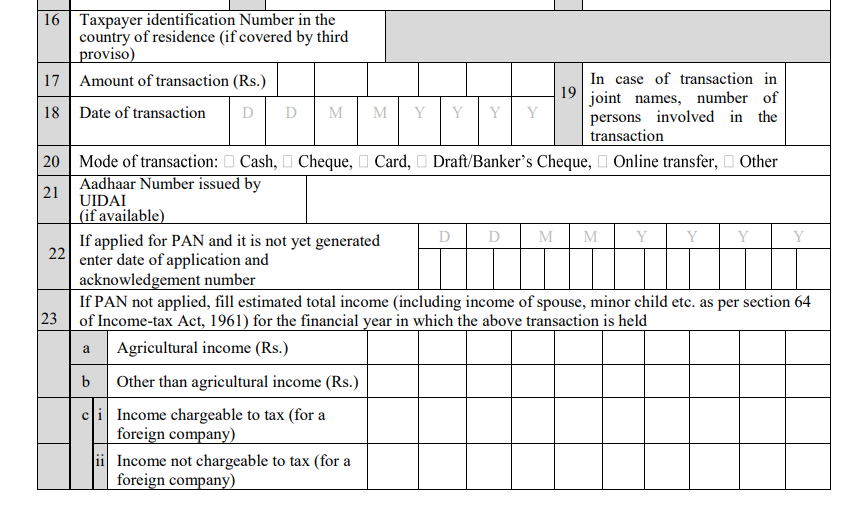

On October 10, 2023, the Central Board of Direct Taxes (CBDT) issued notification no. G.S.R. 728(E), announcing modifications to Form 60 declaration. These changes pertain to individuals without a PAN (Permanent Account Number) or a foreign company involved in transactions outlined in Rule 114B of the Income Tax Rules, 1962. The CBDT has officially introduced the Income-tax (Twenty-fourth Amendment) Rules, 2023, effective from October 10, 2023.

Pursuant to the authority granted by clause (vii) of sub-section (1), clause (c) of sub-section (5), and sub-section (6A) of section 139A, in conjunction with section 295 of the Income-tax Act, 1961 (43 of 1961), the CBDT has introduced the subsequent regulations to modify the Income-tax Rules, 1962.

In the Income-tax Rules, 1962, the following changes have been made to rule 114B:

In the principle rules, in rule 114BA, the following shall be inserted at the end, namely:-

“Provided that the provisions of this rule shall not apply in a case,––

Explanation.–– For the purposes of this rule, “IFSC banking unit” shall have the same meaning as assigned to it in clause (1) of the Explanation to rule 114B.”;

In the principle rules, in rule 114BB, after the proviso, the following shall be inserted, namely:––

“Provided further that the provisions of this sub-rule shall not apply in a case,––

Explanation.–– For the purposes of this sub-rule, “IFSC banking unit” shall have the same meaning as assigned to it in clause (1) of the Explanation to rule 114B.”

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates