The Central Board of Indirect taxes and Customs ( CBIC ), vide notification 05/2024-Customs (ADD) dated 14th March 2024 has decided to continue to levy the Anti Dumping Duty ( ADD ) on Ethylene Vinyl Acetate ( EVA ) Sheet For Solar Module from China for next 5 years.

The designated authority, through notification number 7/12/2023-DGTR dated 20th September, 2023, published in the Gazette of India, initiated a review under section 9A of the Customs Tariff Act, 1975, concerning the continuation of anti-dumping duty on imports of EVA Sheet for Solar Module” originating from China PR.

Following this review, as per final findings published in notification number 7/12/2023-DGTR dated 28th December, 2023, it was concluded that the subject goods continue to be exported to India at prices below the normal value, causing injury to the domestic industry. In light of this, continued imposition of anti-dumping duty was recommended to address the injury to the domestic industry.

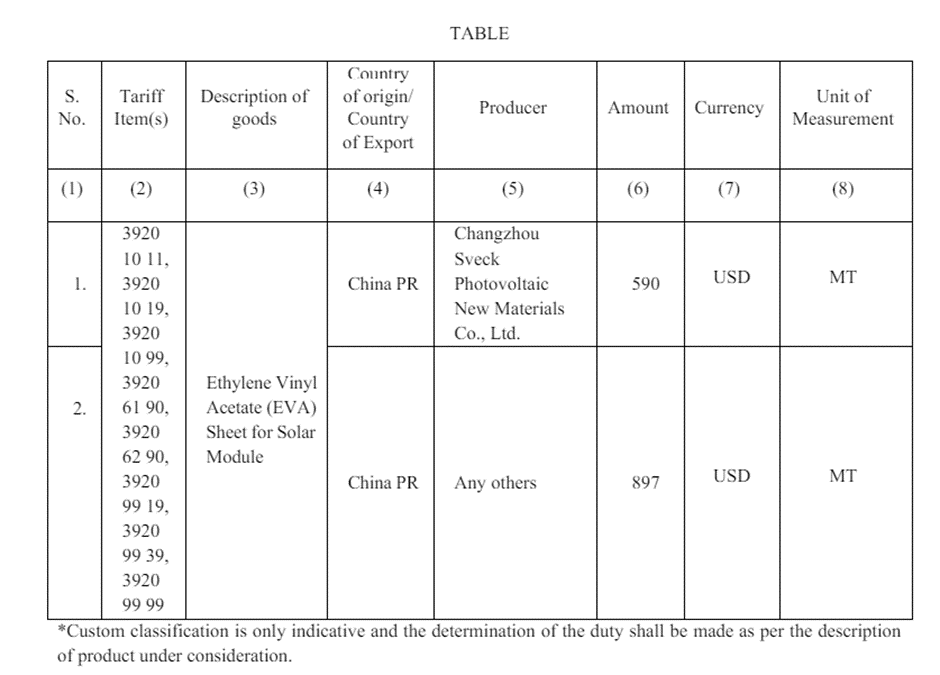

The table showing the ADD, producer and country is as follows:

In exercise of powers conferred by section 9A of the Customs Tariff Act, 1975, read with relevant rules, the Central Government imposes anti-dumping duty on the subject goods for a period of five years from the date of publication in the Official Gazette, payable in Indian currency.

Explanation.- For the purposes of this notification, rate of exchange applicable for the purpose of calculation of such anti-dumping duty shall be the rate which is specified in the notification of the Government of India, Ministry of Finance (Department of Revenue), issued from time to time, in exercise of the powers conferred by section 14 of the Customs Act, 1962 (52 of 1962), and the relevant date for the determination of the rate of exchange shall be the date of presentation of the bill of entry under section 46 of the said Customs Act.

Subscribe Taxscan Premium to view the JudgmentSupport our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates