In an age where financial literacy is becoming increasingly significant, Chartered Accountants ( CA ) have long been considered the backbone of financial guidance and tax compliance, including filing of Income Tax Returns ( ITR ). Their role in helping individuals and businesses navigate the complex web of tax laws is indispensable.

We try to gain insights into Devaluation of Professional Services offered by Chartered Accountants and Tax Practitioners by Family and Friends

Recently, a trend has emerged where some CAs are asked by family and friends to file Income Tax Returns ( ITR ) without charging any fee.

This development has sparked a debate, raising questions about the implications of such a practice. Is it a benevolent move aimed at helping those in need, or does it pose a threat to the profession and the quality of service?

Read Also: Netflix Series on CA Topper to set Stage for Heated Debate: Wait and Watch

The Looming Concerns

Quality and Sustainability of Services

While the intention behind offering free services is noble, there are concerns about the sustainability and quality of such services. Filing ITRs involves meticulous attention to detail and a thorough understanding of tax laws, which requires significant time and effort. When services are offered for free, there is a risk that the quality might be compromised due to the lack of adequate resources or the sheer volume of clients. Additionally, free services might not be sustainable in the long run, potentially leading to burnout among professionals.

Devaluation of Professional Services

Another critical concern is the potential devaluation of the profession. When CAs offer their services for free, it can create an unrealistic expectation among clients that such high-value services should be provided at no cost. This perception can undermine the value of professional expertise and training, making it challenging for CAs to justify their fees in the future. The long-term impact could be a reduction in the overall earnings of CAs, which might deter new entrants into the profession.

Pressure from Relatives and Friends

Personal Obligations and Professional Boundaries

A unique aspect of this issue is the pressure CAs often face from their immediate circle of family and friends. It is not uncommon for relatives and close acquaintances to request free ITR filing services, assuming it to be a simple favour. While helping loved ones is a natural inclination, it places CAs in a difficult position. Balancing personal obligations with professional boundaries can be challenging, especially when the volume of such requests increases. This can lead to a significant amount of unpaid work, which, over time, can strain both personal relationships and professional commitments.

Current Options/Methods for Filing ITR

Directly Through Income Tax Portal

The most economical option for filing ITRs is directly through the Income Tax Department e-filing website. This method is free of cost and involves using pre-designed templates and a menu-driven process. Taxpayers can log in using their PAN and complete the filing using the department’s software. Once completed, the income tax return can be submitted online as an XML file. Verification can be done via physical signature, Aadhar authentication, digital signature, or online banking verification.

Filing Through Chartered Accountants (CAs)

Many taxpayers opt to engage a Chartered Accountant for filing their ITR. CAs typically handle the entire process, from preparation to submission, based on documents like Form 16 and Form 26AS. The cost for such services generally ranges from ₹1,500 to ₹2,000, depending on the complexity of the returns, according to Motilal Oswal.

Using Online Third-Party Websites

Alternatively, individuals choose to use online platforms which provide user-friendly interfaces and guide taxpayers through the filing process. Costs here are typically lower, ranging from ₹500 to ₹1,000. Additional fees may apply for special services.

Importance of Timely Filing

Filing your ITR before the deadline not only avoids penalties but also ensures compliance with tax laws. Late filing can lead to penalties under Section 234F of the Income Tax Act. As the deadline for filing income tax returns ( ITR ) for the financial year 2023-24 (assessment year 2024-25) approaches, individual taxpayers not subject to audit should complete their filings as soon as possible. This deadline applies to individual taxpayers whose accounts do not require auditing.

Regulatory and Ethical Considerations

The Institute of Chartered Accountants of India ( ICAI ), the governing body for CAs in India, has established guidelines and ethical standards for its members. While there is no explicit prohibition against offering free services, CAs must ensure that their actions align with the broader ethical framework of the profession. It is crucial for CAs to maintain transparency and avoid any practices that could be perceived as soliciting clients unethically or engaging in unfair competition.

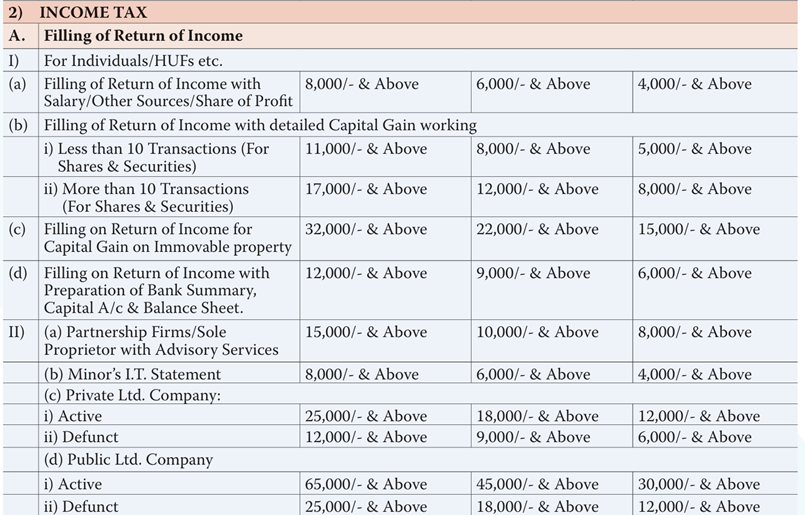

It is worthwhile to note that the minimum fee recommended by the Institute of Chartered Accountants of India – ICAI, for ITR filing is Rs. 4000/-, Rs. 6000/- and Rs. 8000/- for Class C, Class B and Class A cities respectively.

A Balanced Approach

A balanced approach might be the most prudent path forward. CAs could consider offering pro bono services selectively, targeting specific segments of the population, such as senior citizens, students, or low-income individuals. This targeted approach ensures that the most vulnerable groups receive the necessary support without broadly devaluing the profession. Additionally, establishing clear boundaries with family and friends regarding professional services can help maintain the integrity and sustainability of the practice of Chartered Accountants.

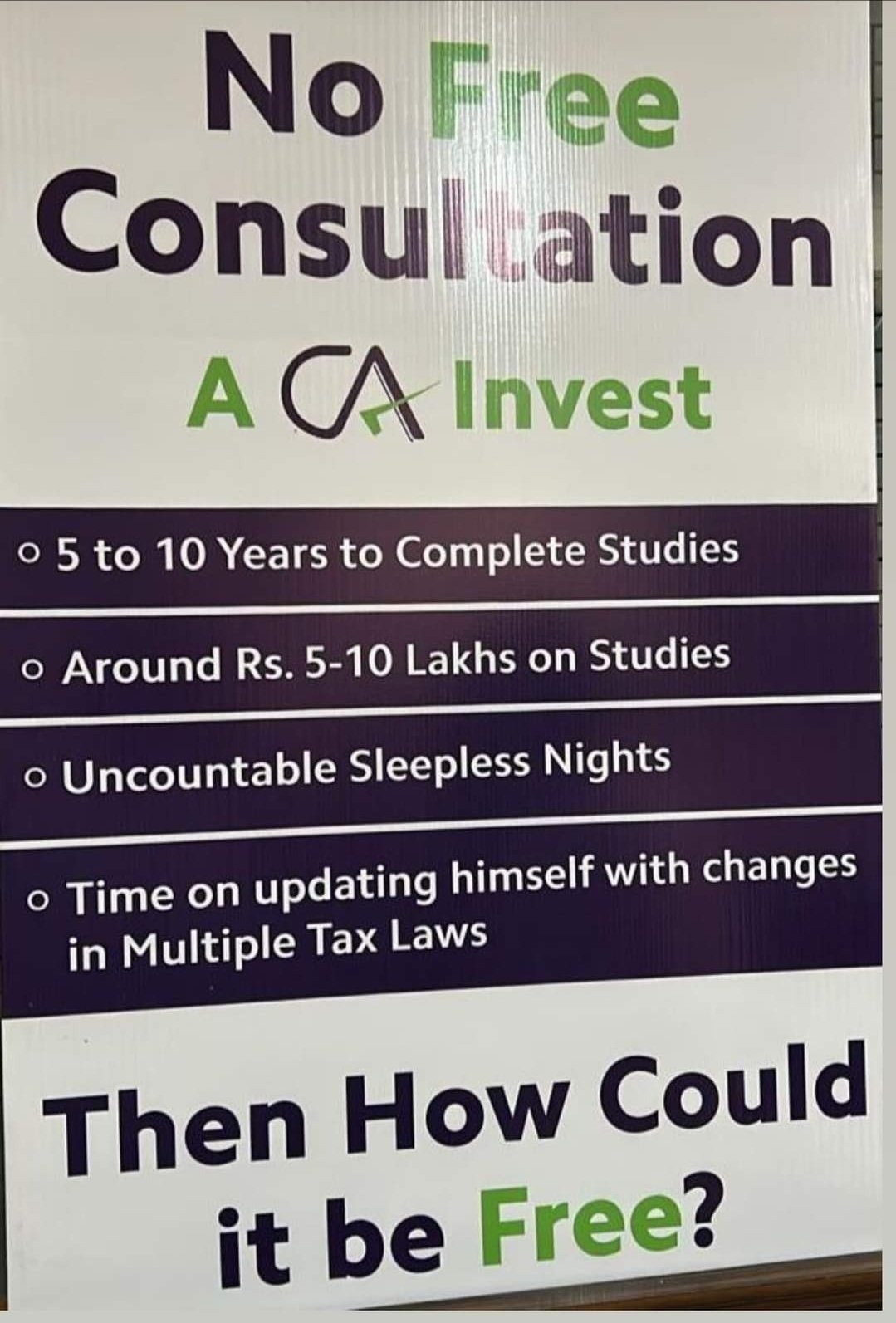

Given below is an image from the office of a Chartered Accountant, making rounds on the internet.

“It depends, on what the services are and the time involved In general, though, I’d say that it is pretty normal to do a small professional service for a relatives or friends for free, Such things are a great gesture to them, but when it becomes a significant project, it is totally reasonable to be paid for your work and your expertise”, said CA Amil Kumar from Kozhikode, Kerala.

“I personally believe in supporting our clients and their families alike in every possible way And even if we charge less fees or no fees at all in case of friends and relatives the same is taken up with utmost care and professionalism”, he added.

Conclusion

The practice of CAs filing ITRs without a fee is a double-edged sword. While it undoubtedly has the potential to provide significant relief and enhance financial inclusion, it also poses challenges related to sustainability, quality, and professional valuation.

As this trend evolves, it will be essential for the Chartered Accountants and clients to engage in a dialogue that balances benevolence with professional integrity and sustainability. Only through such a balanced approach can the profession continue to thrive while serving the broader societal good.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates