In a recent update, the Goods and Services Tax Network (GSTN) has introduced a revamped design for the Notices and Orders Tab on the GST Portal, streamlining access to critical information for taxpayers.

This redesign aims to enhance user experience by providing a more intuitive and organized interface for taxpayers navigating the GST Portal. With categorized sections for different types of notices and orders, users can efficiently locate and respond to critical communications from tax authorities.

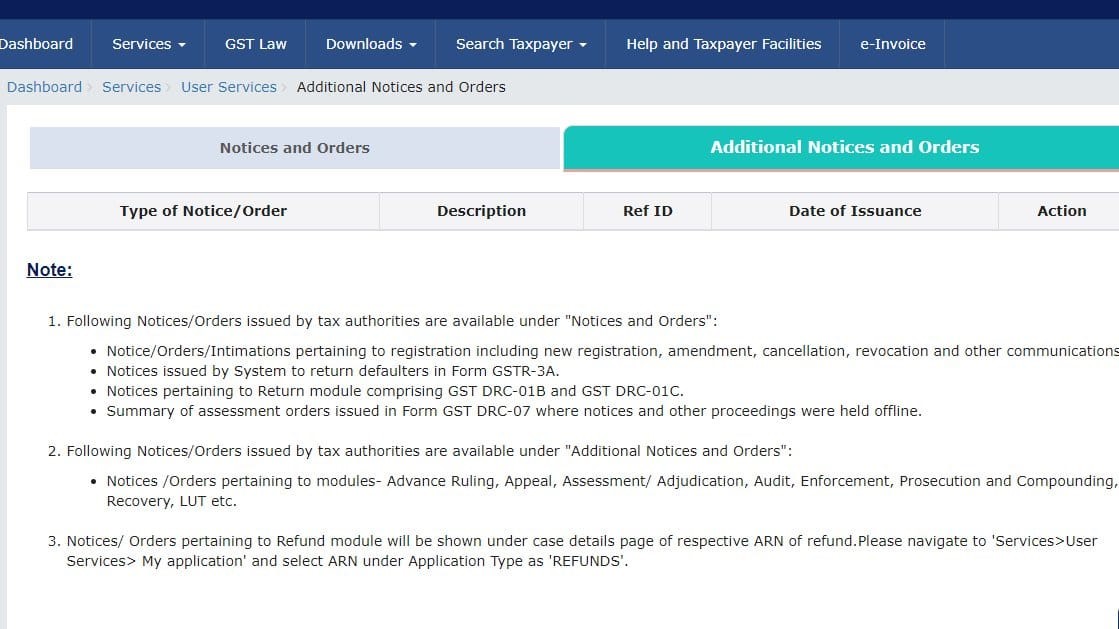

1. Following Notices/Orders issued by tax authorities are available under “Notices and Orders”.

• Notice/Orders/Intimations pertaining to registration including new registration, amendment, cancellation, revocation and other communication

• Notices issued by System to return defaulters in Form GSTR-3A.

• Notices pertaining to the Return module comprising GST DRC-OIB and GST DRC-OIC.

• Summary of assessment orders issued in Form GST DRC-07 where notices and other proceedings were held offline.

2. Following Notices/Orders issued by tax authorities are available under “Additional Notices and Orders”

• Notices /Orders pertaining to modules- Advance Ruling, Appeal, Assessment/ Adjudication, Audit, Enforcement, Prosecution and Compounding, Recovery, LUT etc.

3. Notices/ Orders pertaining to Refund module will be shown under case details page of respective ARN of refund.Please navigate to ‘Services>User

Services> My application’ and select ARN under Application Type as ‘REFUNDS’.

Taxpayers can experience the improved design by logging into the GST Portal and navigating to the “Notices and Orders” tab. The new layout promises to simplify the process of understanding and responding to various notices and orders issued by tax authorities. This update aligns with GSTN’s ongoing efforts to optimize the portal for user convenience and compliance.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates