Customers need to be vigilant when consuming food or making purchases at businesses operating within the framework of the Goods and Services Tax (GST) system. Primarily, the issue of counterfeit GST bills is prevalent among restaurants. Therefore, it is crucial for customers to verify the authenticity of these establishments by cross-referencing their GST numbers on the official GST portal.

In a recent occurrence, a government employee fell victim to a restaurant’s deception involving a counterfeit Goods and Services Tax (GST) invoice in Kerala’s state Capital. The woman visited a restaurant in the company of her friends and dined there. Subsequently, they were presented with a bill amounting to Rs 751.14. The bill displayed a GST Identification Number (GSTIN) and indicated a GST charge of Rs 48.86.

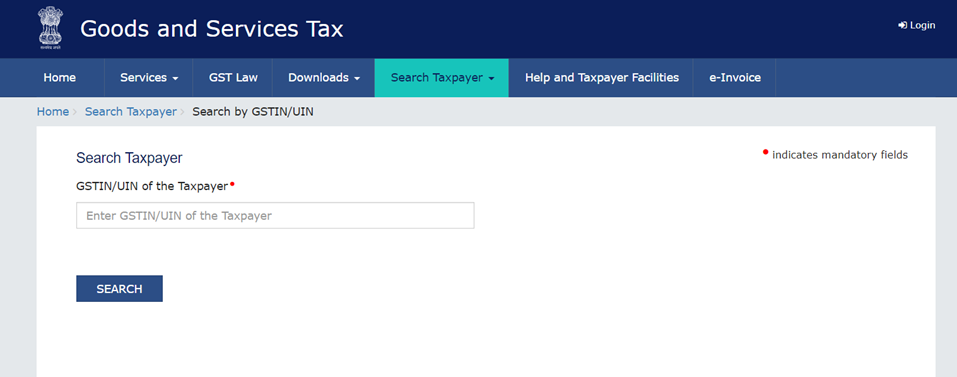

The lady asserted that the bill did not include the HSN code for the products. Suspicious, she cross-referenced the GSTIN on the official GST portal, discovering that the identification number had been voluntarily cancelled since June 9.

Upon requesting a refund from the restaurant staff, her appeal was declined, prompting her to initiate a complaint with the local consumer redressal commission.

The officials stated that they were receiving similar complaints specifically against the restaurants. The consumer can file their complaints either directly at the local state GST office or via email.

The GST invoice incentivisation scheme will definitely help to track the shops or establishments who are charging GST without a GST number or generating fake bills.

How to Check GSTIN in the GST Portal

By adhering to these steps, you can inquire about the GST information of the restaurant or store where you make purchases for their products or services.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates