Now Taxpayers can transfer the amount in Cash Ledger from one GSTIN to another GSTIN registered on the same PAN through Form GST PMT-09.

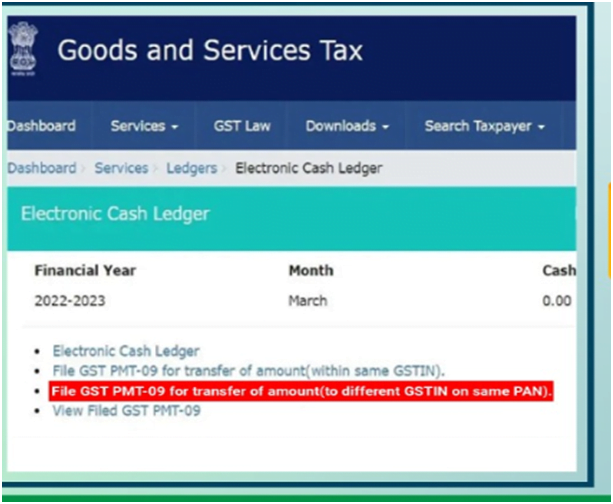

Users can go to Navigate to: http://gst.gov.in>Dashboard>Services>Ledgers>Electronic Cash Ledger to initiate the transfer.

The new provision enables taxpayers to transfer credit from one GSTIN to another, if the same PAN is registered for both the entities. Form GST PMT-09 enables any registered or unregistered taxpayer to perform intra-head or inter-head transfer of amount as available in Electronic Cash Ledger.

Thus, a registered or unregistered taxpayer can now file Form GST PMT-09 for transfer of any amount of tax, interest, penalty, fee or others, under one (major or minor) head to another (major or minor) head, as available in the Electronic Cash Ledger. The same PAN must be registered for both the entities.

Steps to transfer:

Notably, No such transfer shall be permitted if the registered individual has any unpaid liability in his electronic liability register.

This form can be used by GST registered entities who have multiple GSTINs (Goods and Services Tax Identification Numbers) under the same PAN (Permanent Account Number) to transfer funds between their own accounts.

It was earlier used to transfer amount from minor head tax under major head cess to minor head interest under major head CGST or to transfer amount from minor head Interest under major head IGST to minor head Tax under same major head IGST.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates