In November 2023, the total gross GST revenue amounted to ₹1,67,929 crore, comprising CGST at ₹30,420 crore, SGST at ₹38,226 crore, IGST at ₹87,009 crore (including ₹39,198 crore from import of goods), and cess at ₹12,274 crore (including ₹1,036 crore from import of goods).

From the IGST, the government disbursed ₹37,878 crore to CGST and ₹31,557 crore to SGST. The cumulative revenue for the Centre and States in November 2023, post-settlement, reached ₹68,297 crore for CGST and ₹69,783 crore for SGST.

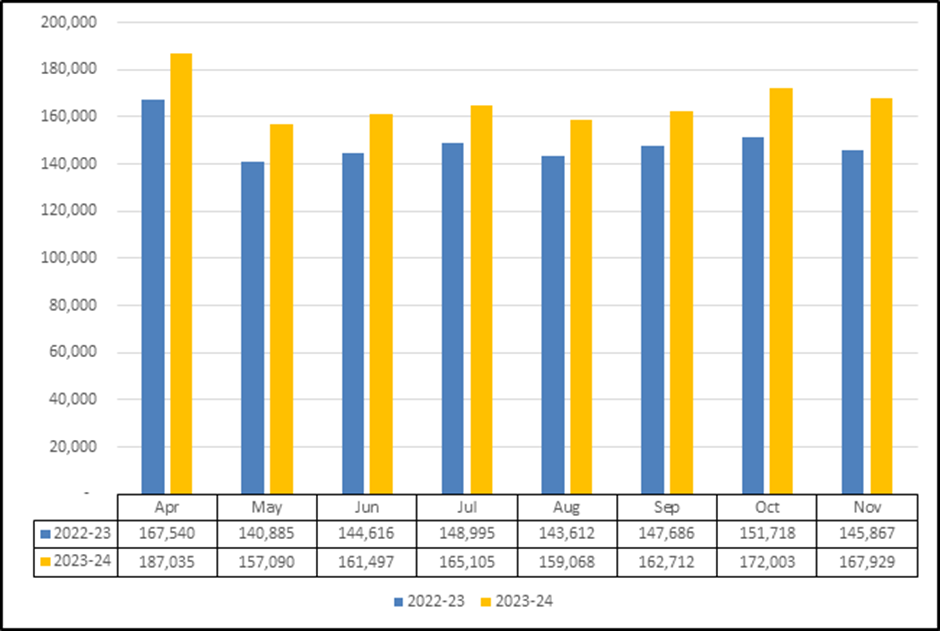

Notably, the November 2023 GST revenues witnessed a 15% YoY increase, marking the highest for any month in the fiscal year 2023-24 until November 2023. Domestic transactions, including import of services, contributed to a 20% growth in revenue compared to the same month last year. This marks the sixth instance in fiscal year 2023-24 that gross GST collection surpassed the ₹1.60 lakh crore threshold.

For the fiscal year 2023-24 up to November 2023, the gross GST collection amounted to ₹13,32,440 crore, averaging ₹1.66 lakh crore per month. This represents an 11.9% increase compared to the gross GST collection for the same period in the previous fiscal year (₹11,90,920 crore, averaging ₹1.49 lakh crore per month).

The accompanying chart illustrates the monthly trends in gross GST revenues for the current fiscal year, while Table-1 provides state-wise GST figures for November 2023 compared to November 2022. Table-2 details state-wise post-settlement GST revenue figures until November 2023.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates