The Institute of Chartered Accountants of India (ICAI) has updated the reporting requirements for fee disclosures in compliance with the revised code of ethics on 6th October 2023.

The announcement states as follows:

“As the members are aware, the provisions pertaining to “Fees – Relative Size” contained in Volume-I of Code of Ethics [Paragraphs 410.3 to R410.6] have inter alia been made applicable from 1.10.2022 with certain amendments. The Announcement dt. 29.9.2022 to this effect may be accessed at https://resource.cdn.icai.org/71662esb57665.pdf and the revised provisions, including pertaining to the “Fees – Relative Size” may be accessed at https://resource.cdn.icai.org/71660esb57664.pdf.

Under the revised provisions of “Fees-Relative size”, disclosure is required to be made to the Institute in case where the gross annual professional fees from an Audit client exceeds the prescribed threshold percentage for two consecutive years.

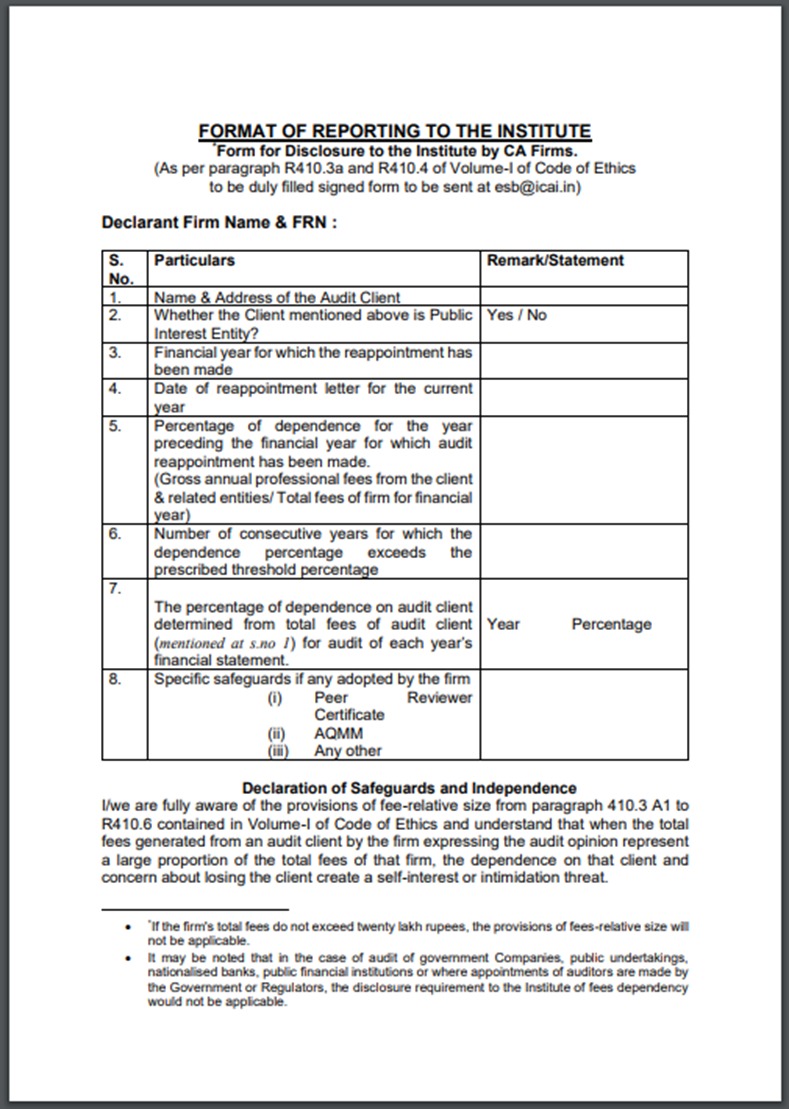

In accordance with the provisions of revised paragraphs R410.3a and R410.4 of Volume-I of Code of Ethics, where the Fees related disclosure is to be made to the Institute, the CA firm shall make the disclosure in the prescribed form duly filled and signed. The form will be sent to Ethical Standards Board via email by CA Firm. The Form prescribed for making the above disclosure is appearing below.”

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates