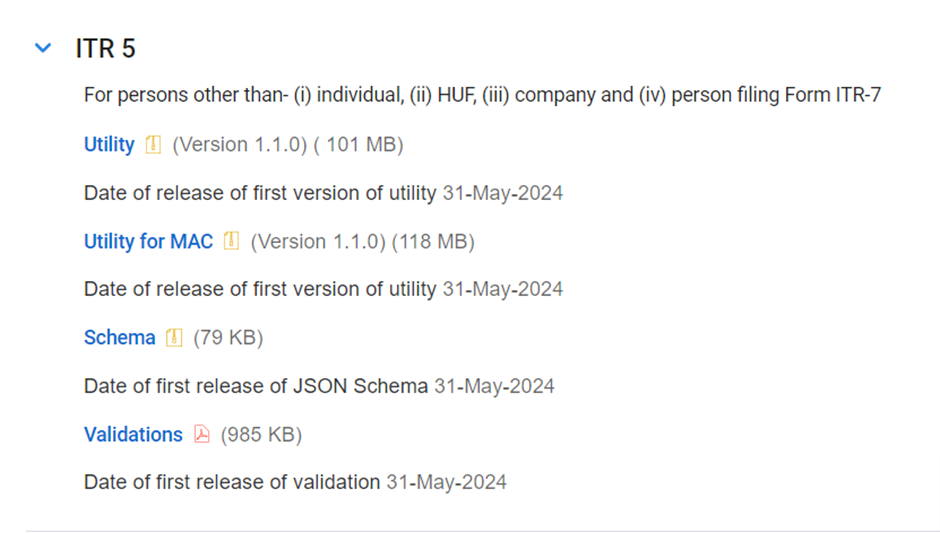

The Income Tax Department has released the latest version of utility, JSON schema and validations of ITR-5 (Income Tax Returns) for AY 2024-25. The form is now available for both offline and online filing in the official website of Income Tax Department (https://www.incometax.gov.in)

ITR 5

This Form can be used by a person being a firm, Limited Liability Partnership (LLP), Association of Persons (AOP), Body of Individuals (BOI), Artificial Juridical Person (AJP) referred to in clause (vii) of section 2(31), local authority referred to in clause (vi) of section 2(31), representative assessee referred to in section 160(1)(iii) or (iv),Primary Agricultural Credit Society, Co‐operative Bank other than a primary agricultural credit society or a primary co‐operative agricultural and rural development bank, Primary Co‐ operative Agricultural and Rural Development bank, any other cooperative society, society registered under Societies Registration Act, 1860 or under any other law of any State, trust other than trusts eligible to file Form ITR‐7, estate of deceased person, estate of an insolvent, business trust referred to in section 139(4E) , investments fund referred to in section 139(4F) and Any other AOP /BOI.

However, a person who is required to file the return of income under section 139(4A) or 139(4B) or 139(4D)shall not use this form.

Last Date to File ITR 5 and Penalty for Delay Filing

The last date to file the ITR 5 is 31st July 2024. Late filing attracts a penalty under Section 234F, amounting to Rs. 5,000, which is reduced to Rs. 1,000 if your total income is below Rs. 5 lakh. Also, an interest at the rate of 1% per month (Section 234A) on the outstanding amount of tax will be levied.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates