The Central Board of Direct Taxes (CBDT) has enabled the excel utility of ITR 6 on 13th July 2023 for the Assessment Year 2023-24. The taxpayers who come under ITR 6 have to file the same. In India, the income tax department requires all businesses, with the exception of those that can retain their income from properties for charitable or religious purposes, to complete the ITR-6 Form and submit it in order to file their income tax returns.

All companies, excluding those eligible for exemptions under Section-11, are required to update their income tax returns using the ITR-6 Form. Companies eligible for exemptions under Section-11 are those that retain their income from property for religious or charitable purposes.

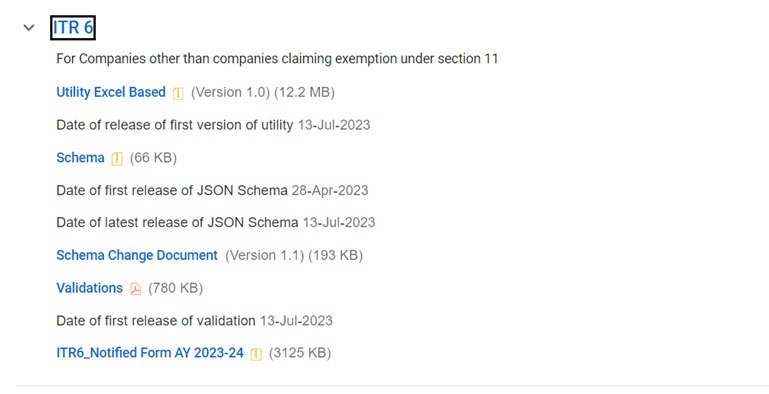

Following are the Links to access utility:

Utility Excel Based (Version 1.0) (12.2 MB)

Date of release of first version of utility 13-July-2023

Document

Schema (66 KB)

Date of first release of JSON Schema 28-Apr-2023

Date of latest release of JSON Schema 13-July-2023

Schema Change Document (Version 1.1) (193 KB)

Validations (780 KB)

Date of first release of validation 13-July-2023

ITR6_Notified Form AY 2023-24 (3125 KB)

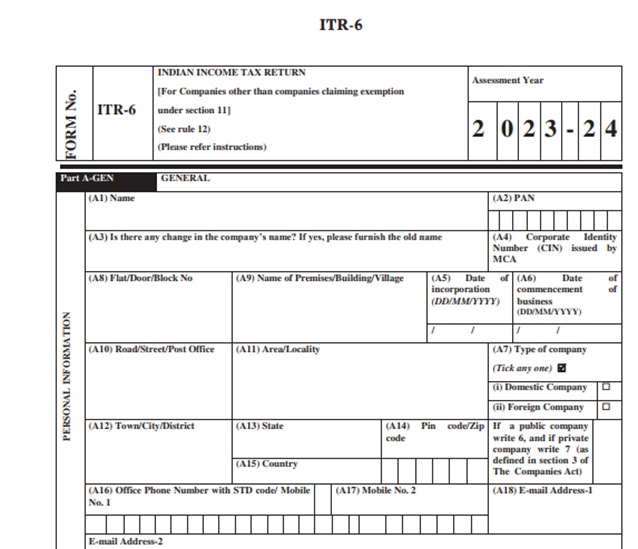

In the Form of ITR 6, Part A is General information including Personal information, Filing status, Audit information, Holding Status, Key persons, Shareholders information, Ownership information, Nature of Company and its businesses.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates