The Institute of Chartered Accountants of India (ICAI) has recommended the Income Tax Returns Filing fee structure based on the nature of work.

In this article, we examine the recommended fee by Institute of Chartered Accountants of India (ICAI) for Chartered Accountant (CA) services such as ITR filing.

For instance, the fees are recommended as follows: 15,000/- and above for a partnership deed, 10,000/- and above for another category, and 8,000/- and above for yet another category.

For a Partnership Deed with consultation and tax advisory, the recommended fees are 20,000/- and above, 15,000/- and above, and 10,000/- and above. For filing forms with the Registrar of Firms, the recommended fees are 7,000/- and above per form, 5,000/- and above per form, and 3,000/- and above per form.

For supplementary or modification in a Partnership Deed, the recommended fees are 12,000/- and above, 9,000/- and above, and 6,000/- and above. For Joint Development Agreements or Joint Venture Agreements, the recommended fees are 12,000/- and above 9,000/- and above and 6,000/- and above. For other deeds such as Power of Attorney, Will, Gift Deed, etc the recommended fees are 5,000/- and above, 4,000/- and above, and 3,000/- and above.

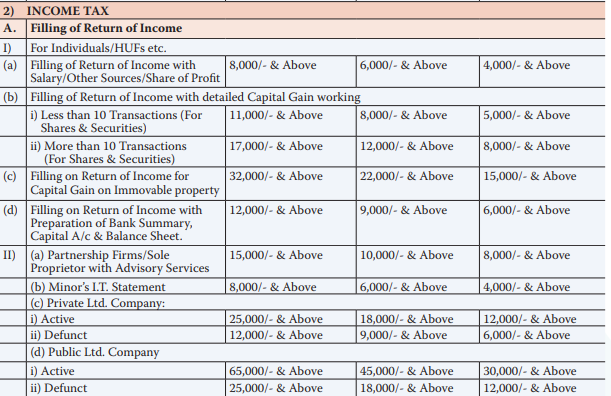

The filing of return of income is mandatory for individuals and Hindu Undivided Families (HUFs) ; the recommended fees are the basic exemption limit prescribed under the Income Tax Act. Filing of Income Tax Return (ITR) at the following fees is required for individuals earning salary, other sources, or share of profit amounts of 8,000/- and above, 6,000/- and above, and 4,000/- and above, fees to be paid respectively.

Filing of Income Tax Returns involves detailed computations based on various criteria. For shares and securities transactions, if there are less than 10 transactions, the fees are Rs. 11,000 for gains of Rs.8,000 or more and Rs. 5,000 for other scenarios. For more than 10 transactions, the fees increase to Rs. 17,000 for gains of Rs. 12,000 or more and Rs. 8,000 for others, as per the ICAI recommendations.

Capital gains on immovable property require filing if gains are Rs. 32,000 or more, with reduced fees for gains of Rs. 2,000 or Rs.15,000. Returns with preparation of bank summaries, capital accounts, and balance sheets necessitate filing recommended fees Rs.12,000, Rs. 9,000, or Rs.6,000 respectively. Partnership firms or sole proprietors availing advisory services must file if their income surpasses Rs.15, 000, Rs. 10,000, or Rs.8,000.

The ICAI has issued recommendations regarding fee structures for Income Tax Returns filing, categorized by entity type and status. For individuals, fees are recommended as 8,000/-, 6,000/- and above 4,000/- for Class A, Class B ane Class C Citites respectively; for private limited companies, active companies are suggested to pay 25,000/- & above, and for defunct companies, 12,000/- and above 9,000/- and above 6,000/- and above; and for public limited companies, active companies with 65,000/- and above, and for defunct companies 25,000/- and above, 18,000/- and above, and 12,000/- and above, 45,000/- and above, and 30,000/- and above, whereas defunct ones have fees of 25,000/- and above, 18,000/- and above, and 12,000/- and above.

The charges for filling out forms and TDS/TCS return vary based on the number of entries. Forms with 5 or less entries start at Rs. 4,000/- and above, while those with more than 5 entries start at Rs. 9,000/- and above. Form No. 15-H/G is charged at Rs. 4,000/- and above per set, and services for Form No. 49-A/49-B start from Rs. 4,000/- and above. All other forms filed under the Income Tax Act are also charged from Rs. 4,000/- and above.

To obtain a certificate from the Income Tax Department, the CA fee recommended is 14,000/- for amounts above 10,000/-, and 7,000/- for amounts above 7,000/-. Filing of Appeal, etc., for the First Appeal starts at ₹32,000 and above, while for the Second Appeal (Tribunal), it begins at ₹65,000 and above, as recommended by ICAI.

The fee has been recommended separately for Class A, Class B, and Class C cities for the filing of Income Tax returns.

Check out the image below for a detailed understanding of ICAI recommended fees for each city.

Enjoy Tax Comedies with Our Combo – Sit, Relax & Read.