The Ministry of Corporate Affairs ( MCA ) has announced significant changes by replacing Form No. ADJ with a newly updated version. This update is part of the Companies (Adjudication of Penalties) Amendment Rules, 2024, which will come into effect on September 16, 2024.

The key modification introduced by this amendment is the insertion of a new rule, 3A, after the existing Rule 3.

The Rule 3A establishes an Adjudication Platform, mandating that all proceedings related to adjudication, such as issuing notices, filing replies or documents, presenting evidence, conducting hearings, attending to witnesses, passing orders, and paying penalties, will now be conducted electronically through the e-adjudication platform developed by the Central Government.

In instances where the email address of an individual required to receive a notice or summons is unavailable, the adjudicating officer will send the notice by post to the last known address or the address available in records, while preserving a copy of such notice in the electronic records of the e-adjudication platform. If no address is available, the notice will be placed on the e-adjudication platform.

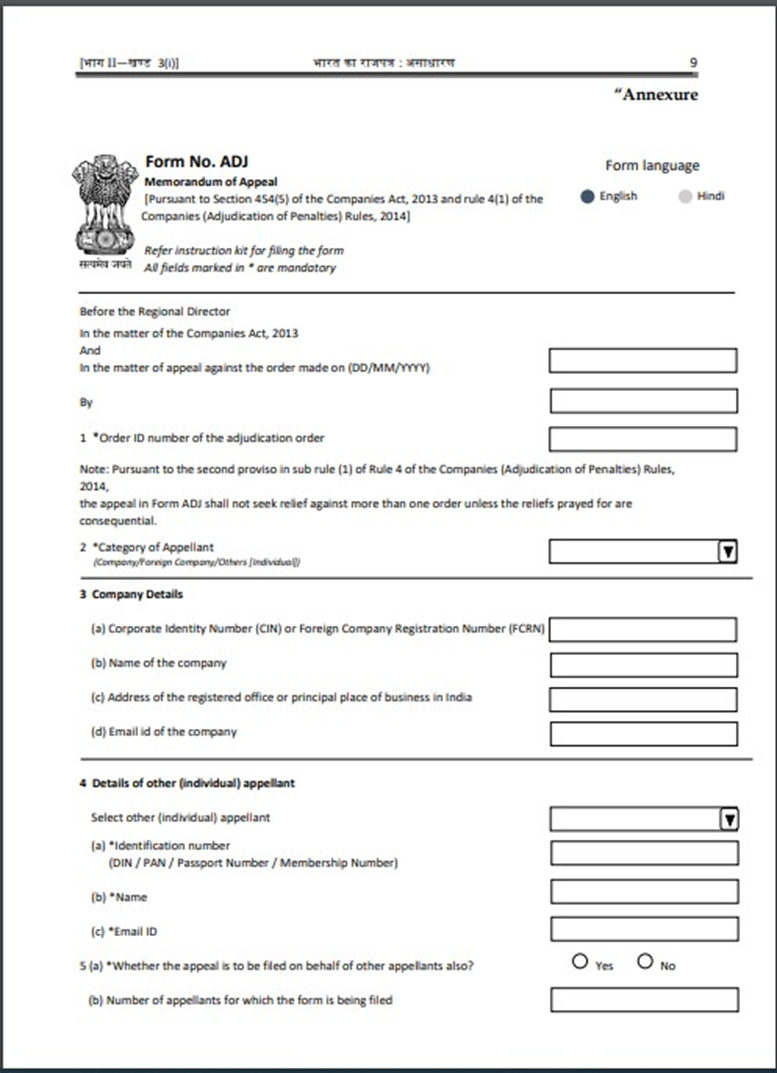

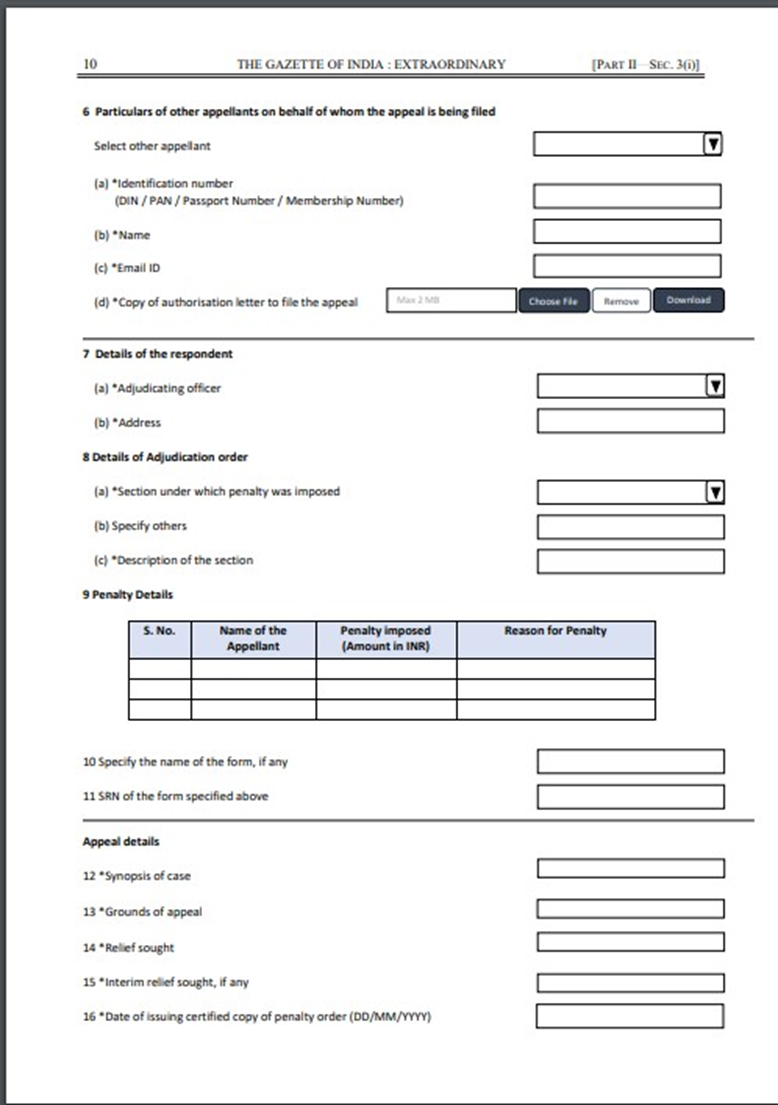

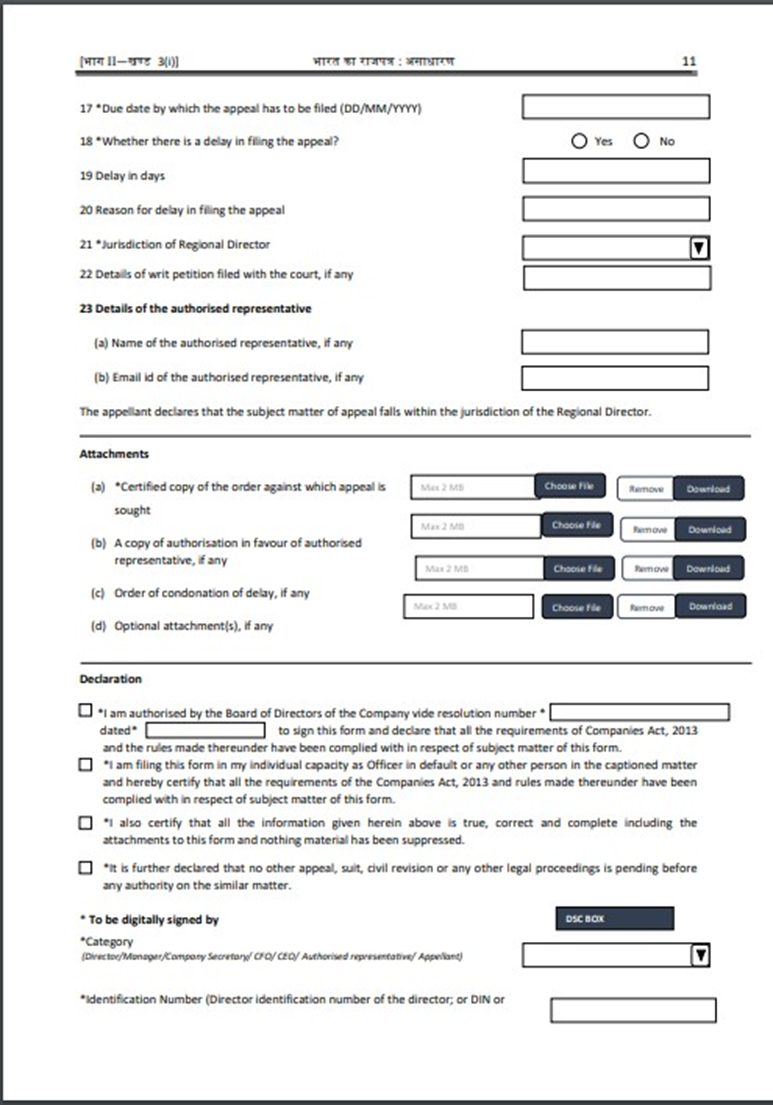

The amendment also replaced the Form. ADJ.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates