The Income Tax Department, in a final warning to taxpayers and PAN Card-holders, had earlier this month tweeted on its Official Twitter handle that, “As per Income-tax Act, 1961, it is mandatory for all PAN holders, who do not come under the exempt category, to link their PAN with Aadhaar before 31.03.2023.”

Section 139AA of the Income Tax Act provides that every individual who has been allotted a Permanent Account Number (PAN) as on the 1st day of July, 2017, and who is eligible to obtain an Aadhaar number, shall intimate Aadhaar number in the prescribed form and manner.

In other words, such persons have to mandatorily link their Aadhaar UID and PAN before the prescribed date (31.03.2022 without fee payment and 31.03.2023 with prescribed fee payment). (For more details refer to CBDT Circular No.7/2022 dated 30.03.2022).

Starting April 1, 2023, PAN holders who haven’t linked their PAN number with Aadhaar will be unable to use it. After the deadline, the ten-digit unique alphanumeric number will be deemed inoperative. Make sure to link your PAN with Aadhaar before the deadline to avoid a blocked PAN Card.

Step 1: Payment of applicable fee either on e-Filing Portal using “e-Pay Tax” service or if bank account is not authorised for payment through e-Pay tax, then payment of Rs. 1000/- is to be done through Protean (NSDL) Portal under major head (021) and minor head (500).

Note: Use “e-Pay Tax service” for payment of fee if you have an account in Banks which are Authorised for payment through “e-Pay Tax” otherwise use Protean (NSDL) Portal for payment of fee.

Banks authorised for e-Pay Tax: Axis Bank, Bank of India, Bank of Maharashtra, Canara Bank, Central Bank of India, City Union Bank, Federal Bank, ICICI Bank, IDBI Bank, Indian Bank, Indian Overseas Bank, IndusInd Bank, Jammu & Kashmir Bank, Karur Vysya Bank, Kotak Mahindra Bank, Punjab National Bank, UCO Bank Union Bank of India. (as on 13.01.2023)

Step 2: Submit the Aadhar PAN link request on e-Filing Portal, either immediately if payment is made through e-Pay Tax service or after 4-5 working days of making of payment if payment is done on Protean (NSDL).

You can also visit the official Income Tax Portal Guide for detailed information regarding the compulsory Aadhar Card PAN Card Linking.

Step 1: On the e-Filing Portal homepage, under Quick Links click Link Aadhaar Status : https://eportal.incometax.gov.in/iec/foservices/#/pre-login/link-aadhaar-status

Step 2: Enter your PAN and Aadhaar Number, and click View Link Aadhaar Status.

On successful Validation, a message will be displayed regarding your Link Aadhaar Status.

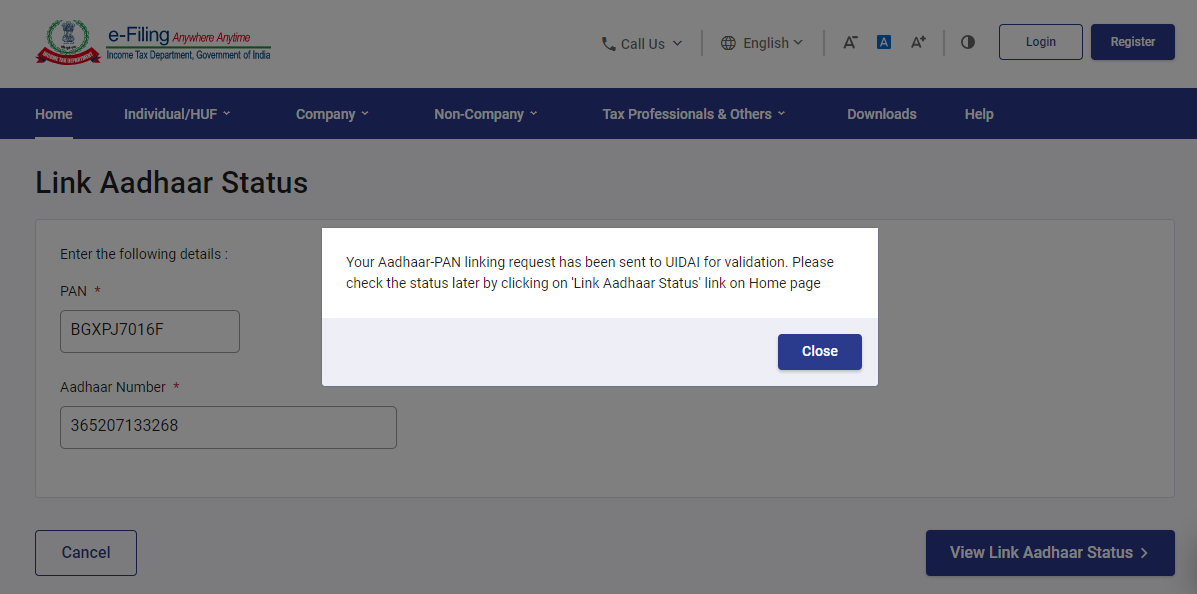

If your Aadhar-PAN Request is processing, then the following message will be displayed:

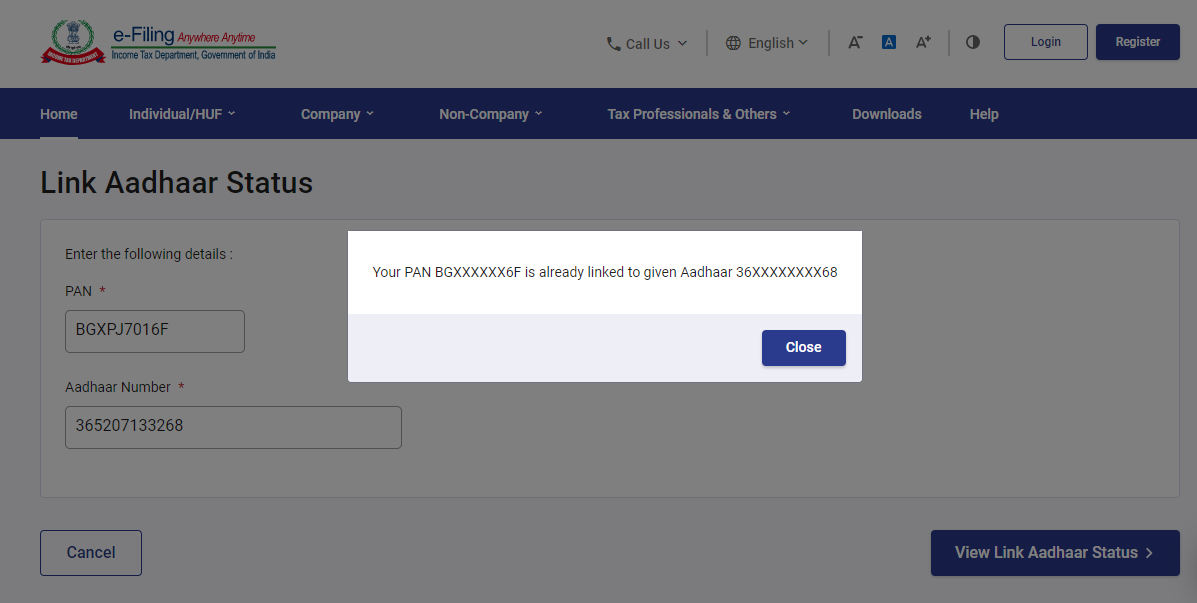

However, if you have a successfully Aadhar linked PAN Card, the following message will be shown:

Aadhaar-PAN linkage requirement does not apply to any individual who is:

Residing in the States of Assam, Jammu and Kashmir, and Meghalaya or a non-resident as per the Income-tax Act, 1961 or of the age of eighty years or more at any time during the previous year or not a citizen of India.

However, the exemptions provided are subject to modifications depending on subsequent government notifications on this subject.

However, for users falling in any of the above categories, voluntarily desires to link Aadhaar with PAN fee payment of specified amount is required to be done.

If you cannot link your Aadhaar with PAN because there is a mismatch in name/phone number/date of birth in Aadhaar and PAN, then do the following –

Correct your details in either PAN or Aadhaar database such that both have matching details. You can correct your PAN details on:

The TIN-NSDL website: https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

or the UTIITSL PAN Online Portal: https://www.pan.utiitsl.com/PAN/mainform.html;jsessionid=B3A9443C26F9755063EFD5A7B32B2E11

Further, in case of Query/Assistance, please contact on NSDL /UTI helpline number: 03340802999, 03340802999 or write on the e-mail id: utiitsl.gsd@utiitsl.com

You can correct your Aadhaar details on the UIDAI website https://uidai.gov.in/my-aadhaar/update-aadhaar.html

In case of Query/Assistance, please contact on toll-free number 18003001947 or 1947

Where a person whose permanent account number has become inoperative is required to furnish, intimate or quote his Permanent Account Number (PAN) under the Act. It shall be deemed that he has not furnished, intimated or quoted the permanent account number as the case may be in accordance with the provisions of the Act and he shall be liable for all the consequences under the Act for not furnishing. intimating or quoting the permanent account number.

Consequences of an inoperative PAN under the I-T Act include: inability to file tax returns, non-processing of pending returns and refunds, incomplete proceedings, higher tax deduction rates, and difficulty accessing financial services. Ensure that your PAN Card is active to avoid these implications by linking it with an Aadhar Card at the earliest.

Further, the Rule 114AAA of the Income Tax Rules informs taxpayers that if a PAN of a person has become inoperative, he will not be able to furnish, intimate or quote his PAN and shall be liable to all the consequences under the Act for such failure. This will have a number of implications such as:-

(i) The person shall not be able to file return using the inoperative PAN

(ii) Pending returns will not be processed

(iii) Pending refunds cannot be issued to inoperative PANs

(iv) Pending proceedings as in the case of defective returns cannot be completed once the PAN is inoperative

(v) Tax will be required to be deducted at a higher rate as PAN becomes inoperative

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates