Receiving an Income Tax Notice, especially for a rebate claimed under Section 87A in the New Tax Regime, can be a cause of concern for many taxpayers. A common form of this notice comes under Section 143(1) of the Income Tax Act, where discrepancies or computational adjustments are pointed out by the Income Tax Department based on your filed Income Tax Return ( ITR ).

Understanding the nature of this notice, and how to respond effectively, can save you from income tax penalties.

This article guides you through the steps to respond to a demand under Section 143(1) of the Income Tax Act, specifically related to availing the rebate under Section 87A of the Income Tax Act, along with frequently asked questions (FAQs) to clarify the most important key aspects.

Comprehensive Guide of Law and Procedure for Filing of Income Tax Appeals, Click Here

FAQ – Responding to Section 143(1) Notice

Q1. What is a Section 143(1) Notice?

A Section 143(1) notice is issued by the Income Tax Department as a summary assessment based on your filed ITR (Income Tax Return). It compares your reported data with the records of the department.

Q2. Why did I receive a Section 143(1) notice?

You received this notice because discrepancies were found between your filed income and taxes paid or because the department needs to inform you about adjustments made to your return based on computational errors or deductions claimed.

Comprehensive Guide of Law and Procedure for Filing of Income Tax Appeals, Click Here

Q3. What should I do if I agree with the notice?

If you agree with the adjustments made in the notice, you can pay any outstanding tax demand mentioned in the notice within the due date.

Q4. What should I do if I disagree with the notice?

If you disagree with the notice, you can file a rectification request under Section 154 within the timeline provided in the notice.

Q5. How can I check the details of my Section 143(1) notice?

You can log in to the Income Tax e-filing portal using your PAN and password. Navigate to the “Services” tab and click on “Rectification” to view your notice details.

Q6. How long do I have to respond to a Section 143(1) notice?

Generally, the notice provides a due date by which you must respond. It is essential to act within this period, or interest and penalties may apply.

Comprehensive Guide of Law and Procedure for Filing of Income Tax Appeals, Click Here

Q7. Can I revise my return after receiving the notice?

No, once the return has been processed under Section 143(1), the option to revise the return is no longer available. You can, however, apply for rectification if there are errors in the notice.

Q8. What if I miss the payment deadline mentioned in the notice?

If you miss the payment deadline, interest under Section 220(2) will accrue, and further penalties may be imposed.

Steps to Respond to the Section 143(1) Income Tax Notice:

1. Log in to the Income Tax Portal

Go to [Income Tax Department].

Log in using your PAN and password.

2. Access the Notice

Navigate to the “My Account” section.

Click on “View e-Filed Returns/Forms” and select the relevant Assessment Year (AY).

Locate the Section 143(1) notice.

Comprehensive Guide of Law and Procedure for Filing of Income Tax Appeals, Click Here

3. Review the Notice

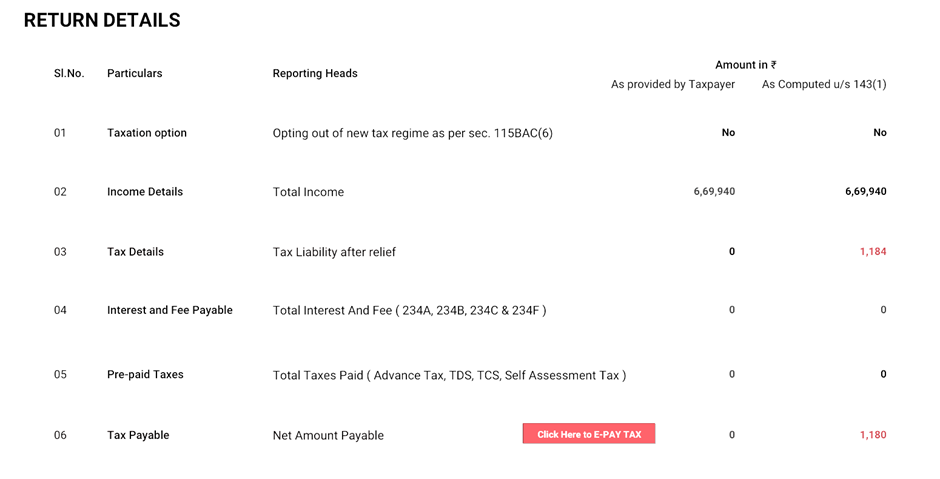

Carefully review the discrepancies mentioned in the notice.

Compare the notice with your original ITR filing to identify any computational errors or missing details.

4. Respond to the Notice

If you agree with the notice, proceed to make the payment. Go to the “e-Pay Tax” section, select “New Payment” and choose “Demand Payment as Regular Assessment Tax.”

If you disagree, file a rectification under Section 154:

Go to the “Services” tab and select “Rectification.”

Provide your PAN, assessment year, and communication reference number.

Select the reason for rectification and submit any supporting documents if required.

5. Make the Payment (If Agreed)

After reviewing, if a demand is raised and you agree with it, complete the payment using the e-Pay Tax system by choosing the correct tax type under the “Demand Payment” option.

Comprehensive Guide of Law and Procedure for Filing of Income Tax Appeals, Click Here

6. File a Rectification (If Disagreed)

If you believe there are errors, file for rectification under Section 154 of the Income Tax Act.

You will need to upload supporting documents proving the discrepancy in the notice.

Track your rectification status through the same portal.

7. Wait for Confirmation

Once the response or payment is submitted, keep checking the portal for confirmation of the resolution.

This process will help ensure compliance with the notice and avoid further income tax penalties or legal complications.

Whether the notice is due to errors in claiming the rebate under Section 87A of the Income Tax Act or other computational issues, it is important to respond within the specified timeline. By either accepting the demand and making the payment or filing for rectification under Section 154, you can resolve the issue and maintain compliance.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates