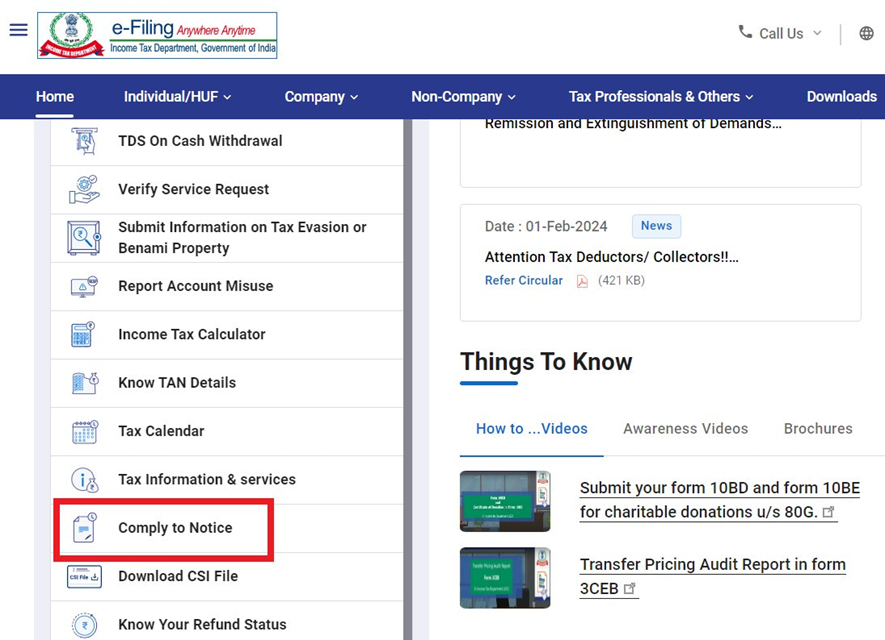

In recent times, taxpayers have increasingly encountered notices under Section 133(6) of the Income Tax Act, 1961, which often pertain to assessment proceedings concerning other individuals. Upon receiving such notices, taxpayers are urged to utilise the Comply to Notices ( CTN ) option available on the Income Tax Portal.

These notices, visible in the E-Proceedings Tab of Other PAN/TAN (and not the taxpayer’s own), raise the need for prompt and accurate responses to ensure compliance with tax regulations.

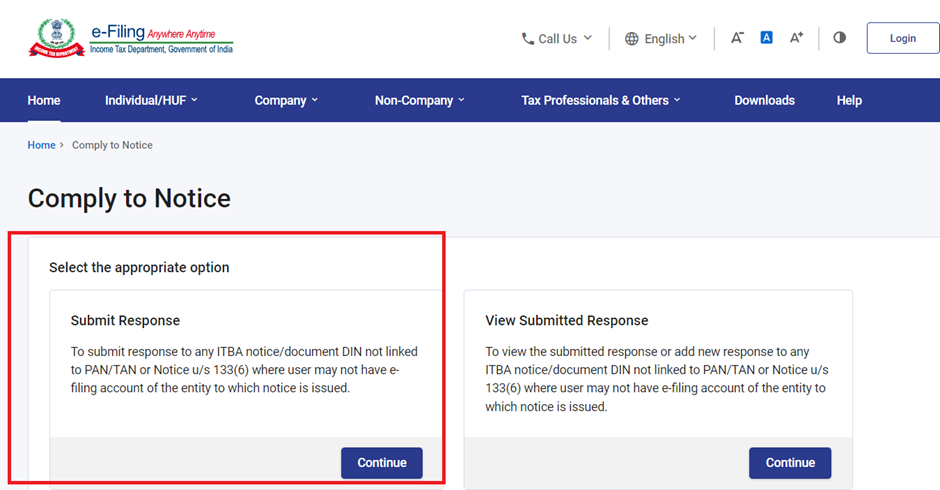

The user-friendly feature simplifies the response process, allowing individuals to provide necessary information efficiently. The portal facilitates the submission of responses by entering the DIN ( Document Identification Number ) and other pertinent details, ensuring a straightforward and secure transaction.

Remember, you can reply to these notices either through the E-Proceedings Tab or using the CTN facility. But if you get a notice by email and it’s not in the E-Proceedings Tab, make sure to use the CTN facility. This is important to avoid penalties and meet the deadline.

The CTN option is important for taxpayers to fulfill their duties quickly and correctly. Using this tool helps people avoid problems and penalties that come with not following the rules. Also, responding on time keeps the tax process clear and efficient.

Section 133(6) of Income Tax Act

Under Section 133(6) of the Income Tax Act, an Income Tax officer is authorized to request information or statements of accounts and affairs from any individual, including banking institutions or their officials. This information is necessary for the fulfilment of any inquiry or proceedings under the Income Tax Act.

Non Compliance Penalty

The penalty for non-compliance with notices issued under section 133(6) of the Income Tax Act, a maximum penalty for each instance of failure or default is set at Rs. 10,000 under Section 272A. Additionally, the interest and further penalties may be levied for failure to comply with these notices. Even if you haven’t done any transactions mentioned in the notice, you still need to reply to it. Ignoring these notices isn’t a good idea because it could lead to more difficulties from the government.

Support our journalism by subscribing to Taxscan premium. Follow us on Telegram for quick updates